WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

or over a century the auto industry has operated a B2B2C model with car makers (OEMs) wholesaling vehicles and parts to dealers who then retail these goods, packaged with additional services to customers, both private individuals and other businesses. This model has by and large been applied globally, with local variations due to industry structure and, importantly, regulation.

At least over the last several decades various tweaks have been made to mitigate structural weaknesses and cater to evolving markets and customer preferences. OEMs established direct sales channels, at first limited to government and large fleets, eg. rental car companies – and have expanded their coverage over the years, often in collaboration with their captive finance companies. There have also been some exceptions from the general rule, for example, (mostly) French and German OEMs owning retail outlets referred to as ‘succursale’ or ‘Niederlassung’ across European and some global markets. The retail networks also went through a continuous consolidation, reducing the number of outlets and more dramatically the number of owners/investors across most markets. We saw the birth of mega-dealer groups with several hundred stores retailing a wide portfolio of brands. And we have numerous international retail groups today. But the underlying ‘proven concept’ has not changed a lot.

In the meantime, the emergence of eCommerce has turned many other retail industries upside down. In automotive we are mostly still talking about it. Yes, prospects and customers have moved a large part of their pre-purchase research and a similar part of their post-purchase discussions online, but very few customers have so far been able to acquire a new car online. Nevertheless, eCommerce and the digitalization has triggered an intense discussion about the future of auto retail. And the very foundation of the current retail network is being questioned: the franchised new automobile dealer.

‘Going direct’ has become a buzzword, not least because Tesla has been ‘going direct’ from the start and by now owns and operates a global retail network that combines physical outlets with a comprehensive digital offering. Several other new players have ‘gone direct’ in more or less pure ways – take Polestar with their mostly digital and direct sales approach, backed by a physical service network, in the form of ‘old-fashioned’ Volvo dealers. The newly (SPAC-)funded US EV start-ups Lucid, Rivian and Faraday are in various stages of announcing and building their exclusive direct channels – with owned glitzy showrooms and versatile digital front ends.

This ‘fully direct’ approach is not an easily available option for incumbent OEMs with their existing dealer networks. But ‘direct sales’ does not have to mean owning your front-end – several OEMs are either testing or implementing (and many more are considering) a significant contractual change in their networks by converting their dealers to agents. New car sales will then be made directly by the OEM to consumers, while the agent may assist the customer in the process. Swedes and Austrians can now buy Mercedes-Benz cars this way, as can VW ID and Volvo BEV buyers in Europe.

These direct sales approaches certainly have tempting advantages: an ever more digitalized customer journey and the supporting digital performance and lead management activities ideally require a fully integrated tri-party-relationship between OEMs, retailers and customers so each can conduct their activities and meet their specific needs at each step. It is entirely clear that operationally direct sales can make digitalization easier. But the OEMs motivations go beyond gaining operational benefits: better price realisation and lower retailing cost are important objectives of any such strategy. The underlying drivers are also undisputed: direct sales can all but eliminate intra-brand competition (ie. dealers of the same brand competing mostly based on price) and a more efficiently managed direct channel can reduce cost.

However, the devil as so often is in the detail and the alternative – improving the dealer system – also deserves consideration. To stimulate your thinking, we are pitching the two systems against each other in a little competition.

How easy will it be for the agent system to eliminate intra-brand competition and to move up transaction prices? The key is rigid enforcement of sales territories. Compensation must uniquely be paid to the agent who has the assigned responsibility for the home location of the customer, even if another agent entered the customer order in the OEM’s front-end system. There cannot be a work around, otherwise agents will simply give away parts of their commission to lure customers from other territories. Fortunately, the legal frameworks behind such ‘true agent’ systems in many markets allow such full territory protection. Realistically speaking an OEM should not expect to increase transaction prices by more than one percentage point, especially not when key competitors of a brand still work with a traditional dealer model. And they should not forget that intrabrand discounts come out of the retail margin – and clawing them back from retailers is not a given when switching them over to agent status.

The alternative solutions for dealer networks have limited potential left towards this objective: Intra-brand competition was initially fueled by over-crowded dealer networks with highly fragmented ownership – the old pop’n’mom dealerships ‘wherever there is a post office’. Continuous and persistent network restructuring by OEMs has reduced this problem, but the internet’s price transparency and digital disruptors like Carwow have limited the effects of network streamlining. Even a handful dealers in a given market have an incentive to out-price each other especially when stair-step and other volume incentives disproportionally reward the last few cars sold.

for the direct model

How about cost reduction? Since CI and standard-driven facility costs depend only on the network approach of a brand, we can keep them out of this consideration, leaving us with the operating and people cost in showrooms, the cost of inventory and the cost of processes and systems.

Almost all benefits of a highly digitally enabled selling process can also be realized in a traditional dealer channel. Car buyers have for years reduced the number of visits to dealerships – and therefore the cost of taking care of them in the showrooms. The remaining need for product demos and test drives is rather independent of the contractual scheme. However, removing the ‘deal stacking & closing’ elements from the sales process allows to replace the highly sought after and therefore highly paid sales consultants with lower paid product experts. Needless to point out that customer satisfaction will generally increase with the ‘haggling’ removed from the car buying process.

Agents in the new system will obviously no longer hold any new car inventories. They will simply transfer to the OEM, who then can work to reduce their level and cost. However, the resulting cost reduction by pooling stocks (and more production discipline) could also be achieved in a dealer model.

On the other hand, a transition to direct sales will also add cost. The required digital front-end systems don’t exist today and have to be built and maintained (by the OEM). Making direct transactions with end users will also require costly modifications to OEMs’ back-end systems and processes. Also, additional personnel will be required in the National or Regional Sales Companies to manage the new car inventory, to determine transaction prices and to handle customer inquiries – all tasks so far handled by dealer staff. And as with customer discounts it is not a given that the cost savings on the dealer level can be clawed back easily by the OEM in the contract switch. The required investments will have substantial pay-back times for the OEM.

Overall, more of a draw on cost reduction

All coins have two sides – and the other side of the ‘intrabrand competition’ coin is market penetration: dealers in intense competition with each other have every incentive to pursue any lead and sell vehicles to whoever they can. This ensures that local weaknesses in a network are often compensated by other dealers selling remotely into the weak dealer’s home territory, overall raising the brands national market share.

An agent, who will draw commission only from sales in his territory will make no such effort. And the formerly weak dealer will not suddenly become a strong agent – as a consequence the brand will inevitably lose market share to competitors in his territory, reducing the national average. It is not easy to envision ways how a direct selling NSC can compensate such localised weaknesses.

Looking at the agents’ own territories a lack of motivation cannot be completely ruled out: the commission is guaranteed for every sale the OEM makes in the territory – selling, after all, is now the NSC’s task. It is quite easy to imagine how the status change can impact morale, ambition, and motivation in what is in essence still a people business. “Why try hard and go the extra mile, for example to provide a test drive to a prospect at an inconvenient time?” Or why follow up the third time with an indecisive prospect? Why keep your showroom well maintained and equipped with state-of-the-art amenities? Let the NSC’s website do the job – and make money in aftersales.

On market penetration, the ‘old’ dealer system wins

1. Switching national networks on a fixed date – and staggering regional markets along a longish transition period.

A market-by-market switch makes the inevitable financial consequences easier to shoulder. The revenue lost during the sell-out of existing dealer stock is spread over several years, as is the parallel extension of the OEM’s balance sheet with retail stock. Therefore, the length of the required transition period only depends on the OEM’s financial and change capacity. For a specific dealer, however, the switch is a one-time event that can be properly prepared to minimize negative effects – in our opinion the easier to manage approach.

2. Introducing the new system with new models – a new BEV-subbrand for example. This transitions a whole region at the same time but leaves both systems at work under one and the same rooftop.

Approach #2 reverses the pros and cons – but puts yet another layer of challenge on the already difficult transition to electric vehicles. The transition itself is bound to span the better part of the decade, raising the change management challenge. Also, there are not many – if any – examples where two different retail systems could be successfully co-operated in the same channel over a longer time. The resulting conflicts of interest make daily showroom operations more difficult – and reduce the OEMs ability to ‘steer’ sales efforts.

While a switch to agents requires a risky change effort, an existing dealer system still needs continuous improvement

For any senior sales executive the dealer-or-agent question is very pertinent today. With an even score in our brief review the decision is certainly not easy to make. We therefore recommend making a decision only after thorough consideration of all factors and implications of both solutions for your specific brand’s situation.

Don’t get seduced by easy cost savings and straight-to-the-bottomline price increases – they might come with expensive side effects like high investments, increased running cost and a loss of market share.

Also, don’t forget in your considerations that some or even many of your competitors will continue to operate the traditional system, but substantially improve it with structural reforms and behavioral changes, reaping certain benefits without all the expense of a switch.

Therefore, plan realistically and do not overestimate potential benefits of the agent system while discounting the required change efforts.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

Featured Insights

n recent weeks, the Chinese OEM NIO has been in the news for entering Europe’s EV market via Norway. Eventually, NIO aims to repeat its success in China by expanding into major European automotive countries, including Germany, France, and the UK.

The frequent mistake made by Chinese OEMs is to assume that success at home is replicable abroad. Thus, they take their existing EV portfolio, digital ecosystem and sales model and simply transplant them to Europe, on the basis that what works well in China will work equally well in Germany or other European automotive markets. For example, Chinese OEMs try to completely bypass Europe’s traditional wholesale retail system and use the agent model instead.

Chinese OEMs face other obstacles in Europe. So far, the limited brand recognition achieved by Chinese vehicles has generally been unfavorable, due to safety concerns. Many European customers remember Landwind, the Chinese-built SUV that failed a crash test conducted by the national automobile club ADAC in 2005, causing lasting damage to the image of Chinese cars in Germany.

In early 2021, ADAC conducted another crash test on the Chinese electric car Suda SA01 which is being sold in Germany at a dumping price. The Suda SA01 failed the test with “glaring safety deficiencies”: no airbag, no Electronic Stability Program (ESP), no emergency brake or lane-keeper assistant, and no seatbelt tensioner.

An additional handicap for Chinese OEMs is that European consumers are generally loyal towards traditional brands with persuasive marketing stories, and already have plenty of choice. The lesson here is that OEMs cannot just depend on the quality of the product to generate sales. Nor can they simply rely on dealership groups to do their marketing or to formulate the customer experience.

Willy Lu Wang (1981) joined Berylls Strategy Advisors in 2017. He started his career participating in the graduate program of Audi focusing on production planning. After stations at another strategy consultancy as well as being the strategy director for a German Tier-1 supplier, he is now responsible for the China business at Berylls.

He has a broad consulting focus working for all clients in China, whether they are JVs, WOFEs or pure local players. He is also responsible for the development of AI and Big Data products dedicated towards the Chinese market further strengthening the Berylls End-to-End strategy and product development capabilities.

Wang studied Electronics & Information Technology with focus on Systems and Software Engineering and Control Theory at Karlsruhe Institute of Technology.

Featured Insights

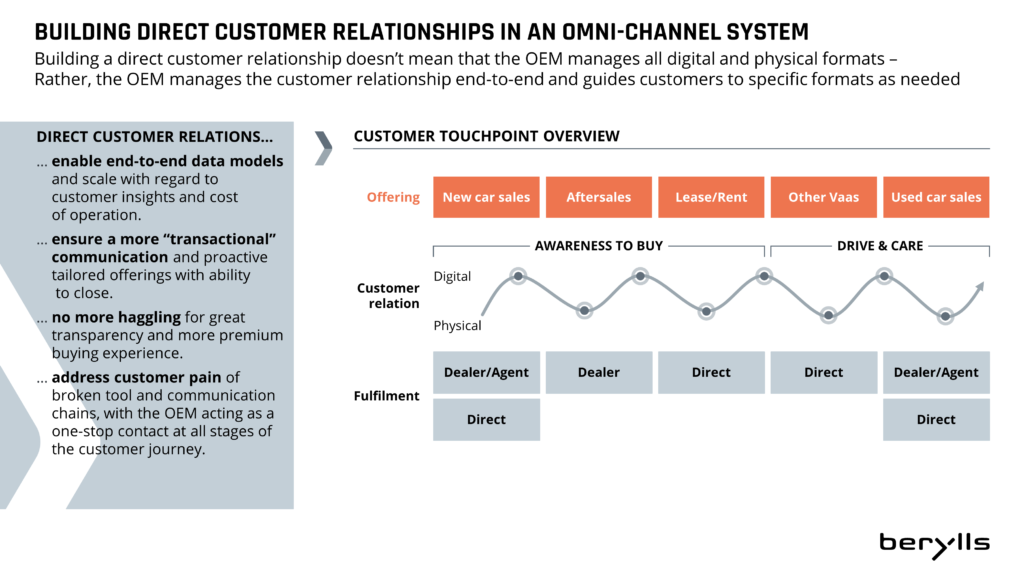

he digital revolution is transforming automotive sales and marketing at an accelerating pace as economies bounce back from the pandemic.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Sascha Kurth (1987) is a Partner at Berylls by AlixPartners (formerly Berylls Mad Media), a company specializing in the automotive industry. He is an expert in building, transforming, and restructuring sales and marketing organizations and has experience from more than 30 projects in this context. From his perspective, it is particularly important for sales and marketing organizations to have clear and measurable goals and a clear and comprehensible strategy for achieving them. Subsequently, the focus is on creating an effective, efficient, and self-optimizing organization from the right people, processes, partners, and necessary governance. Technology and data are crucial enablers for leveraging the efficiency and effectiveness of the resources used multiple times. This is essential to be competitive, remain competitive, and develop competitive advantages for the future. However, they are not an end in themselves but always enablers to achieve the goals (better). Sascha Kurth is convinced that building effective and efficient sales and marketing organizations is a crucial long-term competitive advantage for the entire company and that paid advertising (especially increasing the budget) should be one of the last initiatives to achieve strategic goals.

Sascha Kurth has been supporting automotive manufacturers in a global context since 2013. He has extensive expertise in goal-oriented sales and marketing planning, Paid, Earned, Owned- funnel management, data management platforms & customer data platforms, e-commerce platforms, programmatic advertising, customer relation management, smart KPIs, and management dashboards.

Prior to joining Berylls Mad Media, he supported leading OEMs, e-mobility start-ups, telecommunications companies, and fast-moving consumer goods manufacturers in their sales & marketing transformation at various consulting firms.

Featured Insights

trong competition from strategic investors including OEMs and suppliers, and banks’ pullback from the car industry, are preventing large-scale growth investments and buyouts by private equity investors. Only turnaround investors seeking restructuring cases have been active. But a new generation of car manufacturers can change this in the future.

Seldom has there been so much wealth circulating, in search of attractive investment opportunities. Private equity remains one of the most lucrative investment classes; however the success story does not currently include the car industry. Private equity investments in automotive companies are at present far below average, and falling. That raises questions: why have private equity investors stopped trusting the sector they once loved, and will they return to the auto industry in the future?

Technological change, new business models and macro-economic trends are turning the car industry on its head, leading to a redistribution of profit pools along the value chain. Traditional car manufacturing companies’ profit margins are coming under pressure and strategic investors find themselves forced to restructure their portfolios, in order to remain competitive in the new age of mobility. The car industry is also dependent on highly complex global supply chains and as a result has been more severely affected by production losses caused by wars, pandemics and raw material shortages than other sectors.

More than three years of low returns have resulted in increased debt ratios and tight liquidity positions. Small and medium-sized suppliers have increased their net debts by an average of more than a third in the last few years. Even the major Tier 1 suppliers such as Continental, Bosch, ZF and Schaeffler have had their credit ratings reduced. Consequently, lenders are limiting their exposure to the car industry.

Available loan capital volumes have fallen and interest rates have risen. Traditional banks are cutting back investment in the sector, and alternative loan capital sources do not look much better. Debt funds can invest with a higher risk profile than banks and also sometimes make unsecured commitments. But for these, they need good financial planning and reliable cashflows. Instead, they are confronted with an uncertain outlook and will only get involved on favourable terms, if at all. Asset-based lenders are seen as the most expensive – and therefore the most unpopular – loan capital source.

Due to the synergy potential and longer investment horizons, strategic investors are currently prepared to pay higher purchase prices than financial investors. When prices are at a premium and lenders are unwilling, the value model of buyout funds (purchase price financing through additional debt (leverage) and dividend payments) is no longer sustainable. Other sectors currently provide better returns for private equity because lending conditions are more favorable.

However, carve-outs, succession situations and insolvencies have created many attractive opportunities for turnaround investors in the automotive sector. Strategic investors are put off turnaround companies because of the risk, time and management capacity involved. As a result, turnaround investors find themselves faced with limited competition for target companies.

Reassessing company structures and transferring manufacturing expertise into sustainable and growing product areas sets turnaround companies up for long-term growth. Bolt-on acquisitions and order volumes taken over from insolvent competitors also create economies of scale and improve the negotiating position with customers and suppliers.

For all these reasons, in the private equity space, the automotive sector is currently only attractive to turnaround investors with the necessary expertise. The ability to differentiate between attractive target companies in a fast-changing market, and develop their long-term potential, is essential for investments to succeed. Bringing in the right management capability to realize a company’s operational potential and improve the cost structure, accompanied by a reliable network in the car industry and in the turnaround community, facilitates targeted and efficient restructuring measures and sustainable relationships with all stakeholders.

Venture capital investors are already widely involved with automotive start-ups focused on new technologies and alternative business models, including Vehicle-as-a-Service and shared mobility ventures. As soon as this new generation of companies scales up and their cash flow turns positive, they will be an great fit for growth and buy-out investors’ investment criteria. In this respect venture capital investments can be seen as a precursor to private equity interest.

With greater clarity on what the future of the car industry will look like as time goes on, we expect lenders to regain their confidence and increase their engagement with the mobility industry. Loan-financed investment models will become lucrative again, and growth and buy-out investors will return. For turnaround investors, the intense competition in the car industry and the tremendous pace of development mean there will be no shortage of companies that are left behind and in need of external expertise and capital.

Andreas Rauh joined Berylls Equity Partners as co-founder and managing director in January 2020. Berylls Equity Partners, as the investment company of the Berylls Group, invests in companies in the mobility industry that are in special situations.

Andreas is an expert in private equity, mergers & acquisitions and corporate management.

After ten years in transaction advisory with a focus on medium-sized companies, Andreas moved to the investment sector in 2014. There, he has since accompanied a double-digit number of company acquisitions and sales in a leading role.

Andreas is a business graduate with a diploma from the University of Trier and holds a Master of Science in Business degree from Handelshøyskolen BI.

ar manufacturers have had to react to numerous external challenges in supply chains in the last few years. A shortage of key raw materials could bring about the next crisis – nickel, cobalt and magnesium are possible candidates

Over the last few years the car industry has found itself confronted with a range of major challenges in its supply chains. The Covid-19 pandemic, semiconductor shortage and now the war in Ukraine have done enormous damage. Vehicle production has fallen by 8%, from 90 million units in 2019 to 83 million in 2021.

Car manufacturers and suppliers have rapidly and repeatedly deployed their forces to solve these problems. The Volkswagen group, for example, had to organize various task forces in quick succession to support the market introduction of the electric ID.3, address the chip shortage and tackle the effects of the pandemic.

Volkswagen’s dilemma is representative of a structural problem for the whole of the global car industry: so far, companies have mostly taken only a reactive stance toward this seemingly endless series of challenges in the supply chain. The current situation in Eastern Europe is the latest example of this: some manufacturers are having to arrange second suppliers for wiring harnesses because these used to be produced in Ukraine.

With hindsight, it is obvious that a strategic analysis of new proactive approaches is necessary to reduce risks in the supply chain. So suppliers would be well advised to increase continuous transparency and early recognition of problems and configure supply chains so as to secure access to important markets and raw materials. Furthermore, it will become increasingly important to balance investment decisions between economically preferred options and minimal risk options. Suppliers and vehicle manufacturers need comprehensive knowledge of current and future challenges in the supply chain to put these approaches into practice.

A shortage of important raw materials could potentially be the next major challenge for global automotive supply chains (see Figure 1). Rising energy prices increase the costs of production and transport of raw materials, while the transition to electromobility is forcing suppliers to examine the risk profile for critical raw materials. An analysis of 53 raw materials needed for electric and hybrid vehicles shows an increased procurement risk for 41 of them, in particular nickel, cobalt and magnesium.

Nickel is an important component of lithium-ion batteries, and a higher proportion of nickel increases the energy by volume and in turn the cruising range of battery electric vehicles. As the change to e-mobility accelerates, demand for nickel is forecast to rise by around 48% between 2021 and 2030. Russia is the biggest producer of nickel worldwide. In view of the uncertain duration and outcome that the invasion of Ukraine will have on future trade relations with Russia, the procurement risk rises dramatically.

Cobalt is also an important component of lithium-ion batteries. The price of cobalt has tripled since 2019, and demand is forecast to increase five-fold between 2021 and 2030. At such a rate, worldwide cobalt reserves will be exhausted by 2033. The looming procurement risk for cobalt is concentrated on two countries: the Democratic Republic of the Congo (DRC), which holds approximately 60% of global reserves, and China, which currently controls more than 50% of the DRC’s cobalt production by investing aggressively in domestic cobalt promoters. As a result around 70% of refined cobalt production takes place in China, which explains the car industry’s heavy dependence on this dominant supply chain.

China also meets around 90% of global magnesium demand and could be said to hold a monopoly. The car industry is one of the largest consumers of magnesium, where it is used mainly for lightweight construction and is essential for aluminum production. The industry’s magnesium consumption is expected to rise by an average of 7.6% per year between 2021 and 2030. The reason for this is the need to produce vehicles that are more lightweight in order to minimize emissions of fossil fuels, as well as increasing the cruising range of electric and hybrid models. A continual supply of Chinese magnesium is therefore absolutely crucial for car manufacturers, especially as the substance can only be stored for a short time. In the past year the procurement risk became clear when China reduced its production dramatically to keep within emissions regulations. Magnesium exports from China nose-dived and drove global market prices up by around 700%.

These alarming procurement risks – particularly for magnesium, cobalt and nickel – underline why car suppliers need to take positive and decisive action. It is important to develop proactive and strategic answers promptly to stay on the front foot when it comes to challenges in the supply chain.

Suppliers and manufacturers should first of all increase transparency and early recognition of problems in their supply chains. Data-driven and AI-supported risk-radar systems are necessary. These not only offer transparency through the whole supply chain down to the lowest levels, but they also facilitate forecasts about possible availability shortages through the use of AI.

Suppliers should also configure their supply chains to ensure access to important markets and raw materials. This is of decisive importance for the improvement of production flexibility, as a raw material-specific or component-specific strategy is then developed that determines which components are procured locally or globally. Similarly, a decision should be made on whether to use a single- or dual-source strategy, on the basis of a risk assessment of suppliers and raw materials.

Finally, investments and risks should be balanced against each other. Suppliers need to make a judgment on whether they want to pay a premium for extra supply security, or set up a risk fund to finance “what-would-happen-if” scenarios (for example stoppages or start-up difficulties).

The worst possible option would be to continue to rely on traditional systems and risk management processes in the supply chain and procurement. Since 2020, manufacturers and suppliers have been navigating a global environment in which wars, trade disputes, Covid-19, new technologies and the transition to electric vehicles are the order of the day. Risks have appeared quickly and out of nowhere, and one shortage in the supply chain leads directly to the next. Car suppliers can successfully counter these challenges and effectively minimize the risks through proactive strategic approaches to solving the problems.

Dr Ralf Walker (1969) has been a partner at Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specialising in the automotive industry, since September 2021. His expertise lies in the areas of operations and task forces.

He has been advising automotive manufacturers and suppliers in a global context since 2008. He also has in-depth expertise in the areas of launch & ramp-up management, turnaround management, production & supply chain optimisation, lean management and strategy development & footprint optimisation.

Before joining Berylls Strategy Advisors, he spent 18 years at PwC Strategy&, Booz & Co, Management Engineers and the Fraunhofer IPT, as well as 5 years at GKN as head of the European team and member of the global team for the introduction of lean and business excellence principles, production manager and head of industrial engineering.

He studied mechanical engineering at RWTH Aachen University and completed his doctorate at the Fraunhofer IPT in Aachen.

Peter supports companies with complex strategic and operational challenges in the automotive industry. He is an expert in operations and can look back on many years of experience in the transformation environment. His areas of expertise include development, industrialization, and production. Peter is also responsible for Berylls Digital Ventures’ digital task force solution – elyvate.

Peter also heads the Sustainability service offering at Berylls by AlixPartners (formerly Berylls Strategy Advisors). He supports clients in developing and implementing sustainable business models in the automotive industry.

Prior to joining Berylls, Peter worked for Booz & Company and PwC Strategy&, among others, as a member of the management team. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT) and the University of Technology Sydney (UTS).

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Featured Insights

t present we are experiencing a worldwide shift from conventional combustion engines into buzzing battery-electric vehicles.

New car registrations paint a clear picture of the trend: while worldwide the number of new registrations across all drive systems is set to increase by 5% by the year 2030, the traditional combustion engine is expected to lose significant market share and new registrations for battery-electric vehicles (BEVs) are expected to increase by a global average of more than 30%.

The fundamental building block and prerequisite for this growth will be the availability of sufficient battery cells. In 2021, the annual production capacity for lithium-ion batteries in the U.S., Europe and China was just under 700 GWh. By 2030, annual demand of up to 2,600 GWh is expected in these areas; meeting this would necessitate a 16% annual increase in production capacity. The rapid growth in battery cell demand and accompanying production capacity confronts the supplier industry with some core questions: which structures and business models will enable this growth? Will established market participants react quickly and innovatively to the trend – or will new market participants be able to capitalize on the gaps before existing suppliers are able to close them?

Established suppliers have taken various approaches to the shift to e-mobility, but in the last 10 years we have seen real hype around start-ups focused on battery technology and production. Out of 700 battery-related start-ups founded since 2010, 279 are connected to the car industry. Alongside great market potential and the buzz around EVs, low interest rates in the capital markets have supported this development. The number of EV battery start-ups reached a peak in 2016 and 2017, but has since slowed. As Figure 1 below shows, the majority of such start-ups come from North, Central and South America, although large companies from other regions have successfully been established, especially in the field of cell production. The Chinese supplier CATL, for example, was founded as a start-up in 2011, and by 2019 had tripled its turnover, reaching an impressive €18.1 billion in sales by 2021.

Figure 1: Battery start-ups connected to the car industry, 2010-2021

If we look at the financing of these start-ups, we see a trend toward large financing rounds, particularly in the last few years. Out of more than 200 financing rounds for the start-ups in our analysis, 53 happened in 2021 with an average volume of €119 million. The amount raised has increased seven-fold since 2020, from €900 million to more than €6 billion. Large financing volumes are to be found particularly for the investment-intensive battery producers. The capital raised is needed to expand production capacities in line with the rapidly increasing demand from car manufacturers.

Figure 2: Start-up financing before public first issue after years

As EV battery producers increase in size, it is becoming more difficult for start-ups to break into the market. Entrepreneurs seem to be trying their luck in new and different segments of the battery value chain, and in the last few years start-ups have been founded in fields such as recycling, remanufacturing and services. Both the absolute number and the share of start-ups in the field of battery production have been declining in the last three years (Figure 3).

Figure 3: Automotive battery start-ups by year and value-chain segment

Areas which still offer potential for start-ups are field monitoring of batteries and production, and closing of material cycles. Artificial intelligence is increasingly used in these fields and contributes to quality assurance in field and production monitoring, as well as addressing unresolved sustainability challenges to create customer benefits. One example is the start-up Accure Battery Intelligence from Aachen in Germany.

The question remains: what options do established automotive suppliers have in the EV battery space? The battle for ever-larger production volume is in full cry and market share is distributed between the existing players. As a result, conventional suppliers as well as young start-ups should focus on peripheral areas and build targeted skills there, to drive forward the whole battery ecosystem and solve problems arising along the value stream. They can do this by creating their own capabilities or through acquisition from outside.

Fritz Metzger (1986) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specializing in the automotive industry, in February 2021. He is an expert on automotive operations.

Since 2011, his focus has been on strategic alignment and operational efficiency improvement of automotive manufacturers and suppliers. He also advises top management in critical situations, including R&D and industrialization task forces and relocation and restructuring initiatives of plants and complete suppliers. The challenges of e-mobility are always in focus.

Before joining Berylls, he was a director at international strategy consultants PwC Strategy&, as well as a sales and project manager at a medium-sized supplier and mechanical engineering company.

Fritz Metzger is a trained industrial engineer with a degree from ESB Business School Reutlingen. He also holds an MBA from the University of Salzburg.

Featured Insights

he automotive industry is on the verge of the mostsignificant transformation in its history, as the worldshifts to electric-powered and increasingly autonomous cars.

Dr. Matthias Kempf (1974) was one of the founding partners of Berylls Strategy Advisors in August 2011. He began his career with Mercer Management Consulting in Munich, Germany, in 2000. After earning his doctorate degree and further consulting work at Oliver Wyman (formerly Mercer Management Consulting), he joined the management of Hilti Germany in 2008. At Berylls, his area of expertise is new mobility services and traffic concepts. In addition, he is an expert in developing and implementing new digital business models, and in the digitalization of sales and after sales.

Industrial engineering and management studies at the University of Karlsruhe, Germany, doctorate degree at Ludwig Maximilian University, Munich, Germany.

Malte is an expert in the development and implementation of automotive digitization strategies.

He focuses on helping clients scale (generative) artificial intelligence to improve their bottom line across the entire automotive value chain. His primary customers are automotive manufacturers and their suppliers, especially those active in the Software-Defined-Vehicle space.

Before his time at Berylls by AlixPartners (formerly Berylls Strategy Advisors), he advised leading North American utility companies. Prior to that, he saved lives as emergency medical technician. Malte holds master’s degrees in economics from Maastricht University and Queen’s University in Canada.

Sebastian Böswald (1991) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) in April 2021. He is an Associate Partner and an expert in both transformation and operations. Over the last decade, he has focused his work on strategy and organizational design, as well as on two megatrends shaping the automotive industry: software-defined vehicles and CASE (connected, autonomous, shared, and electrified mobility). In these fields, he has advised our global OEM clients as well as Tier-1 suppliers and tech companies.

Prior to joining Berylls, he worked for PwC Strategy& and started his career at BMW as a project manager for product strategy and digital charging services.

He received a Bachelor of Science in Automotive Computer Science at the Technical University of Ingolstadt as well as a Master of Science in Management from the Technical University of Munich.

Featured Insights

ith cars becoming devices-on-wheels, traditional OEM R&D organizations are reaching their limits. The component-focused organizations, that have at their core not changed since the mid-90s, are failing to tackle the complexity of modern, software-defined vehicles, as they were simply not set-up for this – but there is a tried and tested approach they can adopt.

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market.

Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer. In October 2011, he became a founding partner of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group.

After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Timo Kronen (1979) is partner at Berylls by AlixPartners (formerly Berylls Strategy Advisors) with focus on operations. He brings 19 years of industry and consulting experience in the automotive industry. His focus is on production, development and purchasing as well as supplier management. Some of his recent projects include:

• Restructuring of the Procurement Function (German Sports Car OEM)

• Supplier Task Force for a HV battery cell (German Premium OEM)

• Strategy Development for the Component Production (German Premium OEM)

Before joining Berylls, Timo Kronen worked at PwC Strategy&, Porsche Consulting Group and Dr. Ing. h.c. F. Porsche AG. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT).

Heiko Weber (1972), Partner at Berylls by AlixPartners (formerly Berylls Strategy Advisors), is an automotive expert in operations.

He started his career at the former DaimlerChrysler AG, where he worked for seven years and was most recently responsible for quality assurance and production of an engine line. Since moving to Management Engineers in 2006, he has been contributing his experience and expertise to projects for automotive manufacturers as well as suppliers in development, purchasing, production and supply chain. Heiko Weber has extensive experience in the development of functional strategies in these areas and also possesses the operational management expertise to promptly catch critical situations in the supply chain through task force operations or to prevent them from occurring in the first place.

As a partner of Management Engineers, he accompanied the firm’s integration first into Booz & Co. and later into PwC Strategy&, where he was most recently responsible for the European automotive business until 2020.

Weber holds a degree in industrial engineering from the Technical University of Berlin and completed semesters abroad at Dublin City University in Marketing and Languages.

Sebastian Böswald (1991) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) in April 2021. He is an Associate Partner and an expert in both transformation and operations. Over the last decade, he has focused his work on strategy and organizational design, as well as on two megatrends shaping the automotive industry: software-defined vehicles and CASE (connected, autonomous, shared, and electrified mobility). In these fields, he has advised our global OEM clients as well as Tier-1 suppliers and tech companies.

Prior to joining Berylls, he worked for PwC Strategy& and started his career at BMW as a project manager for product strategy and digital charging services.

He received a Bachelor of Science in Automotive Computer Science at the Technical University of Ingolstadt as well as a Master of Science in Management from the Technical University of Munich.

Featured Insights

hether Germany’s federal election results in a traffic light or a Jamaica coalition, the country’s biggest industry will change in ways that will have an impact across Europe – and in China.

The Green Party has achieved its best-ever election results, taking a 14.8 per cent share of the vote, up 5.8 percentage points on 2017. As a result, the party is now a key player in coalition negotiations that we believe are most likely to result in either a so-called “traffic light” coalition of the SPD, the Green Party and the economically liberal FDP, or the “Jamaica” coalition made up of the CDU/CSU, the FDP and the Greens. We assume that if either of these three-party groups succeeds, and the country avoids falling back on the “grand coalition” of the SPD and CDU/CSU, then the Green Party will claim the Ministry of Transport as its price for agreeing to other compromises.

Of course, OEMs operate on far longer timescales than the four-year government term: planning cycles span 10 years, and models are in production for five years. However, decisions made on green transport policy will undoubtedly have an impact on the country’s dominant car industry. In turn, the size of Germany’s car market, which generates €400 billion a year in sales, means it will pioneer change across Europe and even influence the automotive industry in China.

As we noted at last month’s IAA event in Munich, German OEMs are now making e-mobility their priority, with affordable battery electric vehicles (BEVs) in the best-selling B and C categories planned for the middle of this decade, plus support for the full EV ecosystem, including the all-important charging network. This puts the industry in alignment with the wishes of voters on September 26, and the course is therefore set for transformation on both the product and the market side. But how will the choices of the eventual coalition government affect the plans OEMs and suppliers already have in motion?

The auto sector is the largest industry in Germany, employing 1.8 million people. However, the role of cars in the life of the nation also goes far beyond their industrial and economic contribution. Cars have been dubbed the “favourite child” of Germans, the majority of who remain committed to keeping their individual mobility.

With this in mind, we expect the full focus of the traffic light coalition will be on getting more BEVs on the roads. This will drive lower emissions in line with the Green Party’s goals. It will also support the SPD’s priorities of preserving private car ownership, particularly among lower income groups, and protecting jobs in the car industry, given the close links between the SPD and the labor unions.

BEVs will therefore benefit from government support out to 2025, and this will also help keep Germany on track to meet its EU emissions obligations under the “Fit for 55” program. To achieve the Fit for 55 targets, around 14 million vehicles, or 30 per cent of the cars on Germany’s roads, would have to be electric by 2030.

As well as government support for BEVs, we would also expect a gradual withdrawal of support for plug-in hybrid electric vehicles (PHEVs) and higher taxes on internal combustion engine (ICE) cars. However, the Green Party’s call for ban on new ICE cars from 2030 will not happen in a traffic light coalition, because of the scale of the impact on German jobs.

The combination of the yellow and black strands of this group – the economically liberal and car-friendly FDP, and the CDU/CSU – are likely to be less focused on the BEV, and to maintain a more open position when it comes to alternative technologies for reducing emissions. That would keep PHEV and ICE vehicles, as well as hydrogen-powered fuel cell electric vehicles (FCEVs), in the mix, and would be particularly applicable to commercial vehicles. We would also expect this coalition group to support further research into synthetic fuels (e-fuels) as an alternative to gasoline and diesel.

Maintaining openness on which technology will supersede ICE in the long-term does mean that the right solution would be driven by industry, rather than by politics. However, given the significant investments OEMs have already made in BEVs, it is not clear why the next government would want to undermine their progress. From the perspective of the auto industry, it will be important that maintaining an open mind on which engine technology will “win” in future, and support for research into e-fuels and hydrogen technologies, does not slow down the roll out of the charging infrastructure and other investments needed to ensure Germany and German carmakers meet EU-wide emissions targets.

We expect fuel prices to go up, whether the traffic light or the Jamaica coalition wins. The Green Party are seeking to increase the carbon dioxide tax from €25 per tonne of CO2 to €60 per tonne by 2023. Doing so would increase the additional cost of the CO2 tax on a liter of diesel from around 8 cents to around 20 cents.

However, if the traffic light coalition with the SPD forms the next government, we do not expect the CO2 tax to increase by such an amount. This is because the SPD does not want the cost of the xEV transition to be borne equally by all drivers, when higher income groups currently buy the majority of xEVs. We expect a Jamaica coalition would agree to a gradual increase to close to €60 per tonne, in line with the Green Party’s pledge, by 2023/34.

The scale of Germany’s car industry and its leading position in Europe means the policies taken by the next government will impact the transition away from gasoline and diesel engines across the continent. However, another important point to note is the possible impact in China. The country is the world’s biggest BEV market, and to date, most of the country’s EVs have been made by Chinese OEMs (see chart below). However, the government is scaling back subsidies for BEVs and PHEVs. If growth in the Chinese market slows as a result, BEV subsidies in Germany will make the market more appealing for Chinese OEMs, which are already increasing their sales in this country.

Dr. Alexander Timmer (1981) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specializing in the automotive industry, as a partner in May 2021. He is an expert in market entry and growth strategies, M&A and can look back on many years of experience in the operations environment. Dr. Alexander Timmer has been advising automotive manufacturers and suppliers in a global context since 2012. He has in-depth expert knowledge in the areas of portfolio planning, development and production. His other areas of expertise include digitalization and the complex of topics surrounding electromobility.

Prior to joining Berylls Strategy Advisors, he worked for Booz & Company and PwC Strategy&, among others, as a member of the management team in North America, Asia and Europe.

After studying mechanical engineering at RWTH Aachen University and Chalmers University in Gothenburg, he earned his doctorate in manufacturing technologies at the Machine Tool Laboratory of RWTH Aachen University.