WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

he death knell has been sounding louder and louder for the classic (German) automotive industry in the last few years. The reason behind this? Outdated product ranges, as well as mobility solutions which by-passed customer needs, a complete lack of sustainability in its business model, and slow, inflexible company structures and procedures. No feature of a failing industry was missing in the state of Germany’s most important industry. However, the reality is turning out to be completely different.

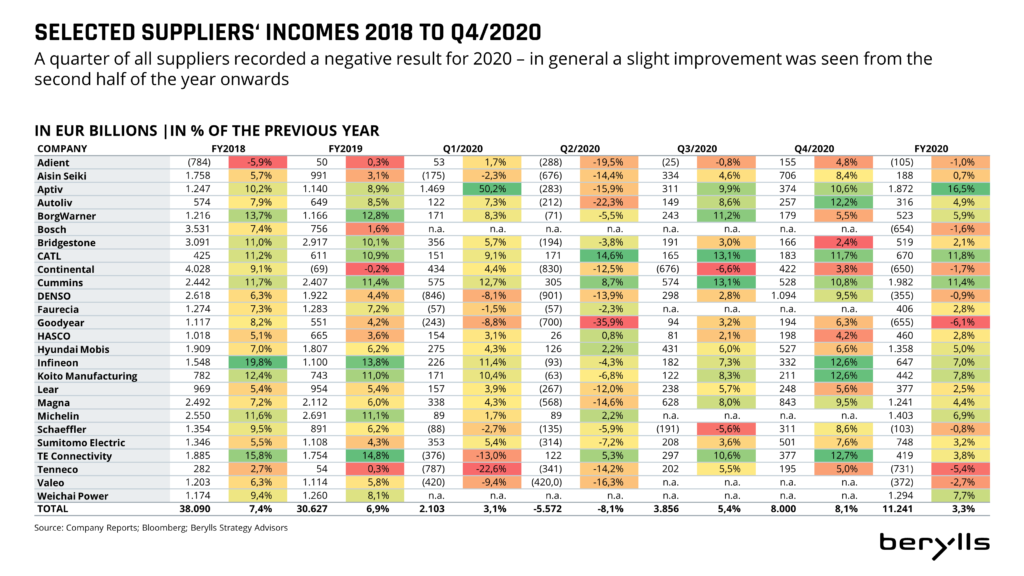

The majority of OEMs and suppliers have been successful in riding out the economic consequences of Covid-19. The predicted wave of bankruptcies has (so far) not materialized. Lessons have been learned from the finance crisis of 2009, in which more than 120 prominent suppliers went bankrupt. Even if supply chains are not yet running smoothly, automotive companies were able to come up with peak values in turnover and profits in the final quarter of 2020.

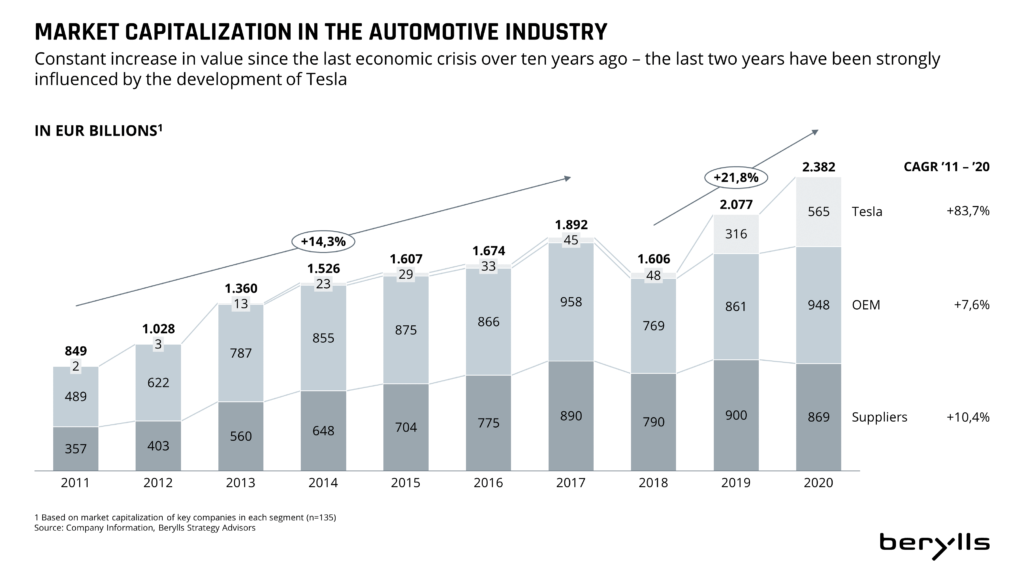

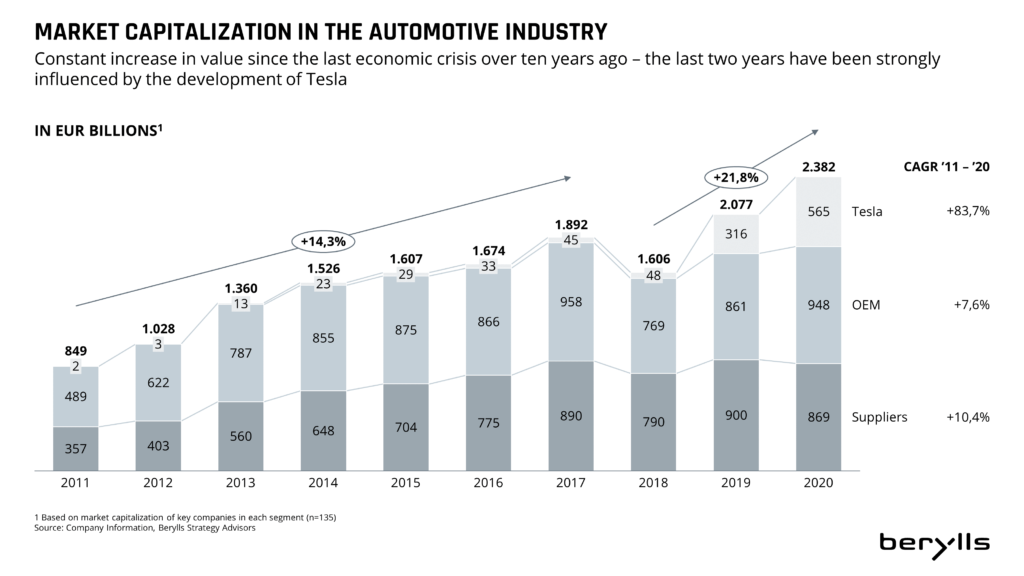

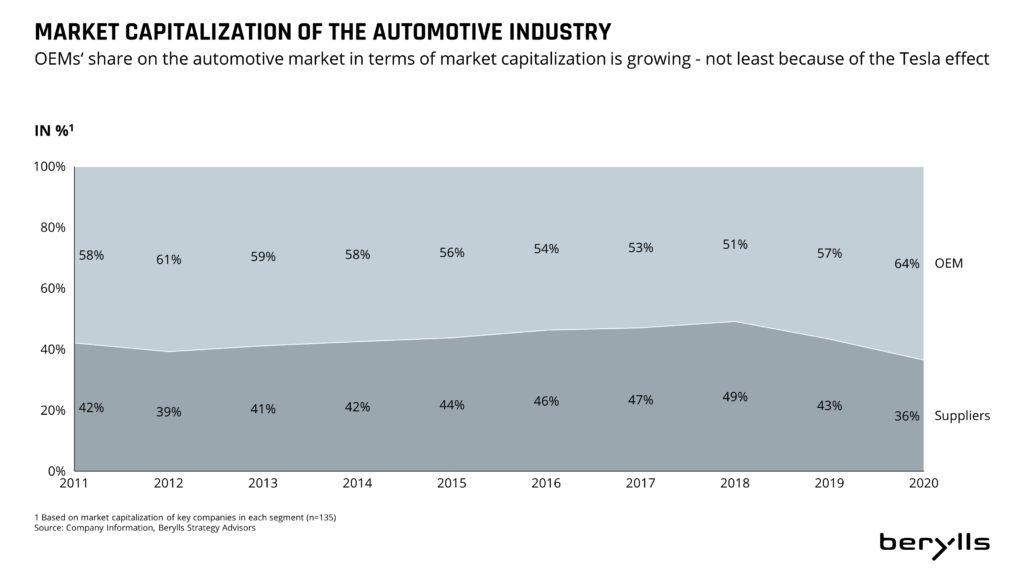

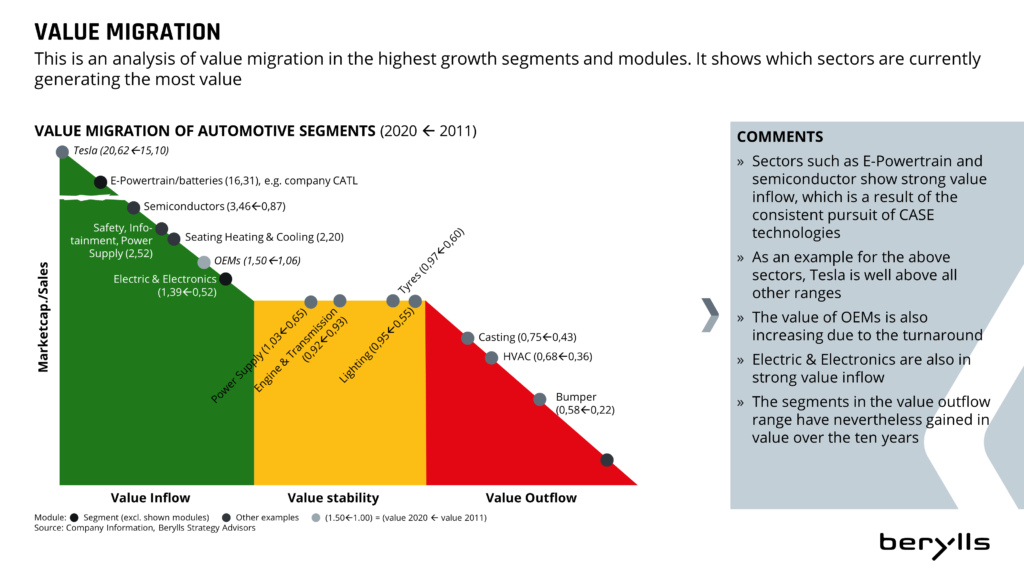

Even the field of electromobility is far from a lost cause. It is true that the present stock market capitalization of the electro pioneer Tesla stands at a good 500 billion euros, just about double that of the three German OEMs BMW, Daimler and Volkswagen. However, Tesla is launching a mere five new models/derivatives onto the market in 2020/21, whereas the German OEMs are producing a veritable flood of models: 88 new vehicles with electric drive (BEV and hybrid). And the Mercedes Benz EQS sets the standard for battery-powered electric cars. Audi has become the first German brand to announce a complete phasing-out of combustion engines. Competitors are racing to catch up.

German OEMs and suppliers are playing an active role in transforming the automotive industry as a whole. One third of worldwide research and development expenditure by automotive manufacturers comes from Wolfsburg, Munich and Stuttgart; in the next 10 years more than 300 billion euros will be spent on innovation. Most of the funds are being directed towards building up software skills, automatic driving, emission-free (electric) drive and connectivity, in order to guarantee attractive car travel in future. Currently, increasingly strict emissions standards can be met: in 2020 the European fleet of new cars just met the limit of 96 grams per vehicle, with 97 grams of CO2 per kilometer. And even the new EU7 regulations will be met thanks to electro-offensives and improved combustion technologies.

Even challenges from the “big tech players”: Google, Apple, Microsoft, Huawei or Samsung, are being confronted and not left to chance. The “software-defined car” has arrived in the higher echelons of suppliers and OEMs. Volkswagen, Bosch, Conti and co. are already employing hundreds of thousands of software developers. And in line with the motto “If you can’t beat them, join them”, new partnerships with big tech companies are continually being established.

The transformation of the automotive industry is by no means complete. German automotive suppliers and manufacturers are, however, doing their homework step by step, and they will be standing among the winners.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

Berylls survey of M&A transactions in the automotive industry (DACH)

he Covid year 2020 has had a significant effect on company takeovers by automotive companies in German-speaking countries. This is shown by Berylls Strategy Advisors‘ annual survey of M&A transactions in the mobility industry. The number of transactions has fallen by 23 per cent in comparison with the previous year and stood at 226 deals (293 in 2019).

The structure of transactions has changed in just about all dimensions, and this is clearly reflected in the attitudes of buyers and sellers in the crisis year and towards the automotive industry in general. On the supply side (sellers) there was little willingness to sell (one’s) company. The “current trading“ and expectations of growth and results were bad in 2020, with the result that even for attractive companies a seller would obtain a bad selling price. Supply was increased by “forced“ purchases: in 2020 the number of companies purchased from insolvency nearly doubled (11 per cent of all company sales), compared with the average in the previous three years. Furthermore, a good 10 to 15 per cent of companies were offered on the market under pressure from investors. Admittedly the average size of mobility companies sold increased, but the prices (equity value) were considerably lower: about 25 to 30 per cent below the long-term average of previous years.

Automotive companies with a “classic” business model were more difficult to sell (-34 per cent) than those with “digital“ (-13 per cent). Classic engineering service providers, automotive suppliers or mechanical engineering companies could be sold more rarely than in previous years. Start-up companies and players which focus on e-mobility, are internet based, offer innovative mobility concepts or are focused on digital infrastructure, were considerably easier to sell.

The financial investors’ share has decreased slightly in 2020, by around -5 per cent. Also fewer private equity investors have contributed growth strategies in acquisitions. As ever, when it comes to classic buy-outs the automotive industry is known to be very difficult terrain. On the other hand, PE institutions with clear focus on special acquisitions are going places, on the one hand with takeovers of insolvent players, on the other with suppliers, mechanical engineering companies and the downstream sector, which are supported by banks‘ workout departments.

The field of buyers from abroad has also become considerably smaller. In 2020, 75 per cent of buyers came from German-speaking countries, another 10 per cent from the rest of Europe, and the rest from the Far East or US. Most notably, Chinese, Japanese, and US Americans have stayed away from the German market during the past year. The number of Chinese buyers has halved since peak value was reached in 2016 (19 transactions and 9 takeovers).

Interest in mobility companies has been growing since the 4th quarter of 2020. Both financial investors and strategic buyers are active again on the market. A complete recovery is not yet in sight. Berylls is anticipating a peak year for sales in 2023 at the latest. The transformation will result in numerous carve-outs for suppliers who were pushed into the background by the Covid crisis. Prices are rising again slightly, and above all the financial investors, who account for about 20 per cent of all takeovers, will be thinning out their automotive portfolios and focusing on new acquisitions.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

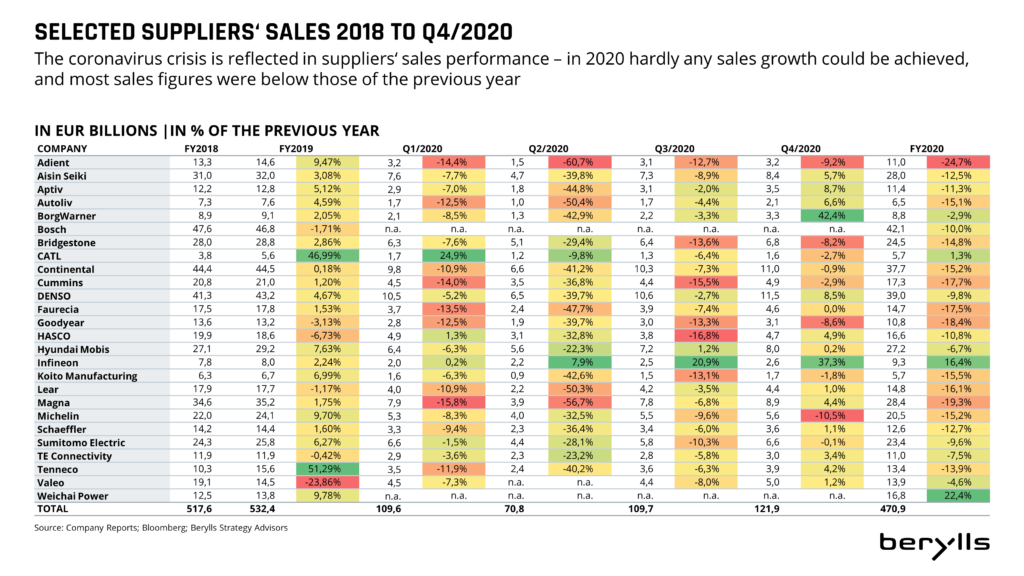

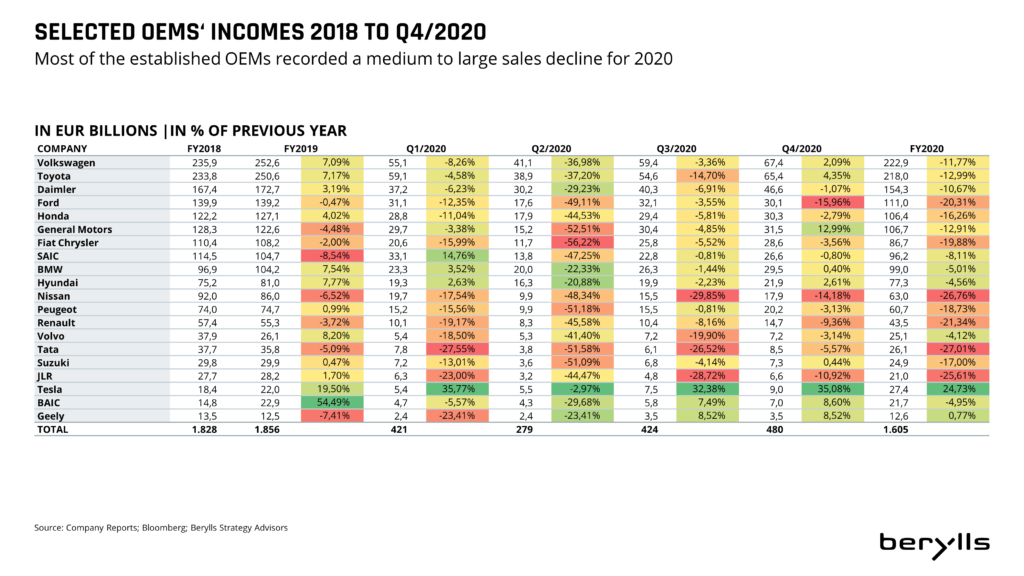

The start of 2020 saw a massive drop in vehicle sales, a double-digit percentage fall due to Covid. So for example, in the first two quarters an average of 35% fewer vehicles were sold in Europe than in the equivalent quarter in 2019.

The world’s largest automotive suppliers generated 11% less turnover than in the previous year.

Operative profit also fell substantially and stood at around -8% in the second quarter. OEM business development showed a similar picture during the same period. Since autumn 2020 we have been experiencing marked signs of recovery in the supplier industry. Both turnover and profits were gaining considerable momentum by the end of the year; some profits with a double-digit percentage. We are expecting a recovery for the period between 2023 and 2026, reaching the levels of the pre-crisis years 2018 and 2019, boosted by the growth in South Asian and South American markets. China and Europe will remain the largest markets by far, but with substantially smaller growth rates.

All this has sharpened the trend towards a two-tier society. The big players are quickly returning to their previous profitability and good growth rates, while the mid tiers get left behind.

Indeed. A majority of suppliers reacted early in the first quarter of 2020 when the first signs of the crisis were coming from China, along with the associated falls in sales. Either performance programs which were already running had their requirements sharpened up, or new programs were launched at short notice.

Suppliers’ austerity programs focused mostly on indirect areas and concentrated more on increasing their efficiency. The focus was on optimizing business procedures supported by automation, as well as adapting organizational structures in central areas. Not infrequently, potential efficiencies in double-digit percentages were identified during the crisis and prepared for implementation. We are expecting to see the full effectiveness and visibility of these in the German supplier industry in the next two years.

The pandemic has highlighted global interdependence alongside automotive added value and the importance of robust supply chains. Not infrequently, OEMs have to coordinate more than 10,000 direct suppliers in more than 50 countries, a task which has become considerably more challenging in the context of the past year.

Production stops caused by Covid have severely shaken the OEM’s fragile supply chains, followed by a gradual acceleration lasting several weeks. We are anticipating that OEMs will invest 20 to 30 percent more in their supply chain excellence in the next few years. This will include AI-supported optimization of supply chains in order to improve transparency throughout all stages of the value chain and make a contribution to sustainability. This is becoming more important, as sustainability is a critical factor in the purchasing decisions of more than half of all customers.

The increased use of AI in supply chain management by OEMs also requires active participation on the part of the suppliers, as for example in the carrying out of self-assessments. We are also anticipating that suppliers will make increasing use of tool-supported solutions to master the complexity of global supply chains.

The Best Owner Group is taking an interesting approach to manage the transformation of selected German suppliers in an ordered and structured way. By streamlining activities in the traditional drivetrain area, efficiency and volume models can be realized and this is intended to give both hard hit suppliers and investors potential returns of 12 to 15 per cent.

Unfortunately, for over a year now we have only got as far as announcements. Above all, the tension between investors for the fund and the (IG Metall) employers’ interests is yet to be solved. It is also unclear how a business which suffers from continual market decline is supposed to generate such high long-term returns. Moreover, the structuring of the fund as “evergreen” – so that no companies from the portfolio are sold, is a high risk in such a market field. Who invests money in a sinking ship, even if it is going down very slowly? If the “funding” does not come to fruition in the coming months, the Best Owner Group will get off to a false start.

The big tech players such as Google, Apple, Microsoft or Nvidia, have already installed their software solutions in a large number of vehicles. Interest is continuing to increase due to the growing importance of automotive off-board software. The value of software amounts to just about 700 euros per average vehicle, and by the year 2030 this will rise to over 2,500 euros, three quarters of which will be generated in the off-board field. As well as the Californian tech giants, Chinese players such as Huawei and Baidu, and the Korean electronics entertainment companies Samsung and LG are entering the “software-defined car” market.

However, tax rates are not the problem when it comes to equal opportunity. It is true that in 2020 the three tech players Apple, Alphabet (Google’s parent company) and Microsoft are only paying between 14.4 and 16.5 per cent income tax, whilst Volkswagen, Daimler and BMW are contributing taxes of between 24.4 and 36.8 per cent of their taxable income. The three German OEMs together would have a higher profit of only around 3 billion euros at a tax rate of 15 per cent. The real problem lies in the pre-tax result, i.e. in the profit itself, not in the taxes. The tech giants are simply much more profitable. They draw an almost 6 times higher pre-tax result than the three German OEMs: 28.1 per cent as opposed to 4.8 per cent. Pre-tax profit for Apple alone is more than double that of the three German OEMs put together.

Hitachi Astemo, created from a merger between Hitachi Automotive Systems, Keihin, Showa and Nissin Kogyo, is a new leading supplier which will certainly appear in the top 20 for the year 2020. Its focus is very clearly the Japanese OEMs, above all Honda (which holds a third of the shares), as well as Nissan, Mitsubishi, Mazda and Subaru. European or North American customers are so far hardly represented. However, the new company has good opportunities in the field of e-mobility in Europe (traction motors, lithium ion cells and battery modules, water pumps and inverters) and autonomous driving (ADAS control devices, camera systems incl. object recognition). Hitachi has for example supplied the inverters for both the Audi e-tron and the Porsche Taycan. But beyond that further scope is unknown.

Delphi sold its “Powertrain”/motor business including e-mobility activities to Borg Warner three years ago for around $3.3 billion. Aptiv’s spin-off, completed in 2018, has been an outstanding development: they were able to double their share price, their market capitalization stands at around 40 billion euros, and all financial figures have improved. Aptiv is a success story. And yes, it serves as a role model for other automotive supplier companies. In the same period, Continental’s market capitalization has fallen by 35 per cent, its returns have dropped and Conti has lost its long-standing position as the second-largest supplier in the world to Denso. The legal spinning-off of Vitesco does mean that a first step has been taken; however Vitesco is still a part of Continental.

The German suppliers in particular are going to have to follow suit, in order to separate themselves from the classic combustion engine business, and focus on the forward-looking CASE business. So far the large European supplier companies have been much too hesitant in their transformation. Valeo, Bosch, ZF, Mahle, Faurecia or Benteler ought to tackle this in a similar way to Aptiv: on the one hand a clean break from the powertrain business, and on the other hand a focus on future business.

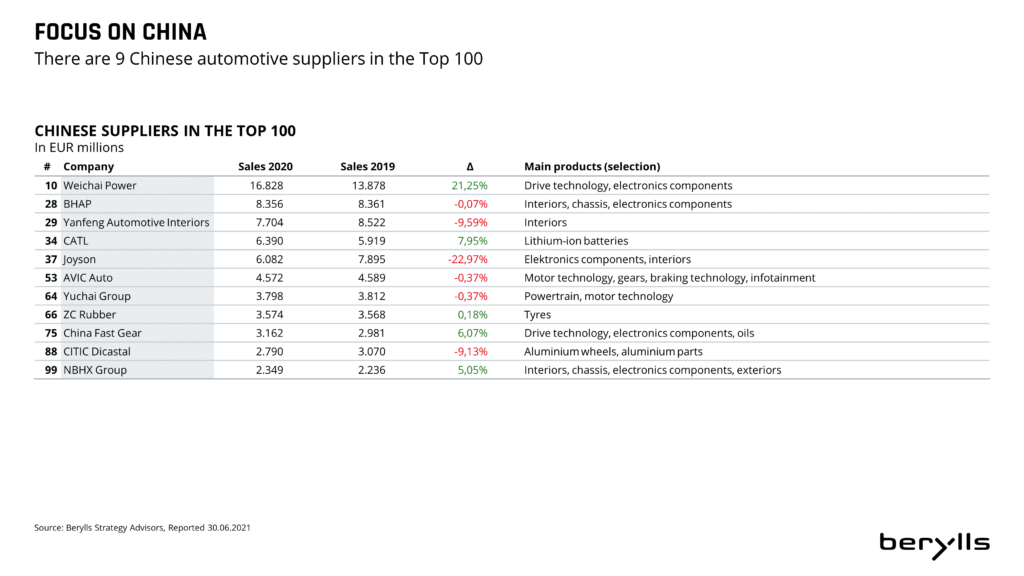

China’s classic players, such as Weichai, Huayu, BHAP, NBHX, Joyson or Yangfeng, will be expanding their European presence step by step in the fields of powertrain, interior or vehicle electronics. However, much more interesting are the new players in the Car OS Operating System (e.g. Huawei Harmony OS), connected services (AliPay and Tencent Integration), autonomous driving (Baidu), e-mobility components, V2X, vehicle platforms and contract manufacturing (Foxconn with the MIH EV platform).

Chinese OEMs will also be increasing their export to (Western) Europe in the coming years and expanding their activities in these markets; how far the Chinese suppliers do the same should be monitored attentively. In China itself, suppliers like Bosch, Conti and ZF must take care not to be overtaken. For this reason they must increase their local activity in the short and medium term and build up local know-how and capacities, especially in the fields of connectivity and autonomous driving. The Chinese government is focusing on “intelligent connected vehicles”, and so interesting opportunities are arising.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

he German federal government has declared its aim to reduce greenhouse gases to a level 55% lower than that of 1990. It goes so far as to envisage complete carbon neutrality by 2050, which is in harmony with the aims of the European Green Deal. In order to achieve this, about 14 million vehicles, or 30% of existing vehicles on the road in Germany, would have to be powered solely by electricity by 2030.

With these regulatory conditions in the background it seems understandable that most European automotive manufacturers are consolidating their exit strategies now and some are envisaging short-term withdrawal scenarios. Audi, for example, is planning the final sales run of its combustion engines for 2025, except for the Chinese market. Production of conventionally powered cars is due to finally end in 2033. Its allied brand Volkswagen and competitors such as BMW and Daimler are following similar approaches.

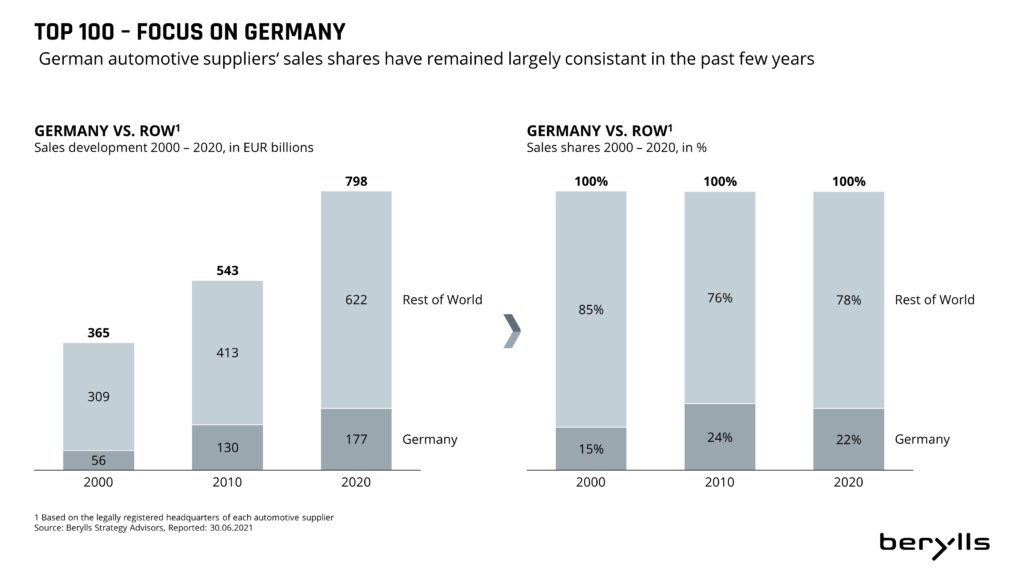

So the paradigm shift from classic combustion motor power to purring e-powertrain seems to be sealed. For the German supplier industry, which with a share of about 22 per cent is the second largest supplier in the global market, this opens up the opportunity to further develop their leading role.

An industrial standard for the high volt architecture (HV) of future vehicle platforms is being established in the electric powertrain sector. The battery system, the e-axis and high-performance electronics are the central components of the electrified powertrain. The battery system constitutes 70 to 80 per cent of the total cost of the powertrain. The concept of central HV architectures is increasingly prominent in the future vehicle platforms up to 2030, in which the individual components of the high-performance electronics are moved to one location at the rear. The aim of this is to gain significant advantages when it comes to material costs and system complexity.

High performance electronics have a significant effect on range, charging time and durability of vehicle batteries. This is another reason why automotive manufacturers increasingly consider installing power electronics like inverters, DC converters and control devices themselves, for part of this volume. In this way the manufacturers can develop their own evaluation skills alongside the established suppliers, and in the tendering process they can negotiate with the suppliers on an equal footing.

The components of the e-powertrain are increasingly subject to heavy pressure on prices, which is partly the result of economies of scale through rising unit sales and increasing customer acceptance of electric drive systems.

New registrations for electric vehicles rose during the past year by 264 per cent in Germany alone, and globally the increase was 38 per cent. By 2026 we estimate that the production of purely electric vehicles will rise by more than 200 per cent.

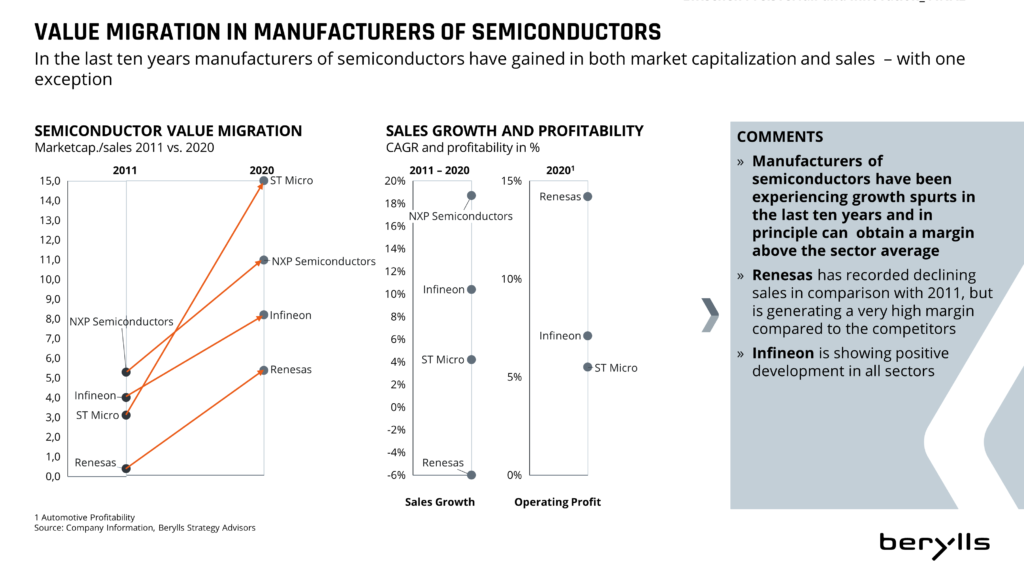

At the same time as the rise in volume, we can expect price reductions of up to 50 to 70 per cent for individual components in the e-powertrain. To counteract this, the big suppliers are increasingly entering development partnerships with semiconductor manufacturers. They are focusing on improvement of efficiencies in power electronics, in order to increase the range of battery-electric vehicles. Suppliers are hoping to counteract price reductions in the long term with technological innovations of this sort.

2021 is a decisive year for suppliers, as they need to get the tenders for the new e-platforms into position and thus secure their share of the e-mobility growth market. This also appears to be a targeted approach against a background of job retainment. Because of the planned discontinuation of the combustion business and the lower staff intensity needed to make electric engines, suppliers are under intense pressure to overcompensate for the expected gap with new projects in the e-mobility sector. The result is a bitter pricing competition for the benefit of the end customer, to make electromobility affordable for the general public.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

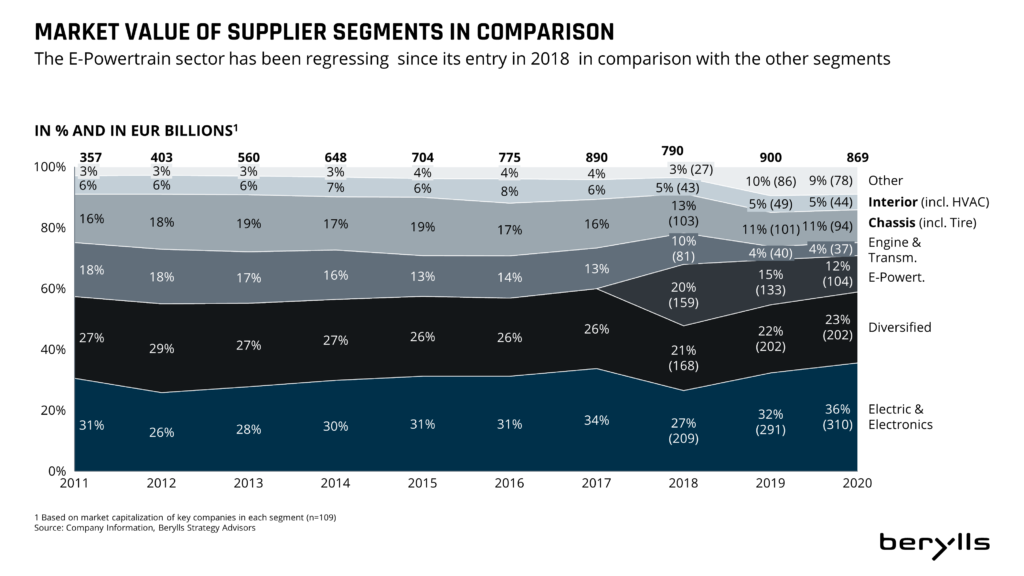

or automotive suppliers, the year 2020 was exceptional. The scale of the disruption can be summarized in four statements: growth was only really possible through acquisitions; one in four companies recorded losses; a Chinese supplier made it into the Top 100 for the first time, and electromobility set the direction for the whole industry.

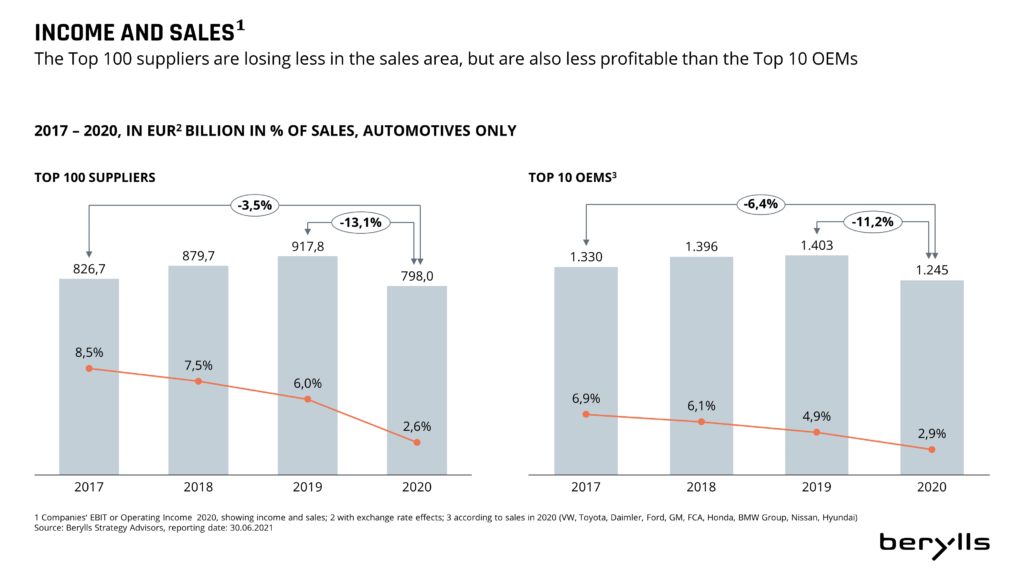

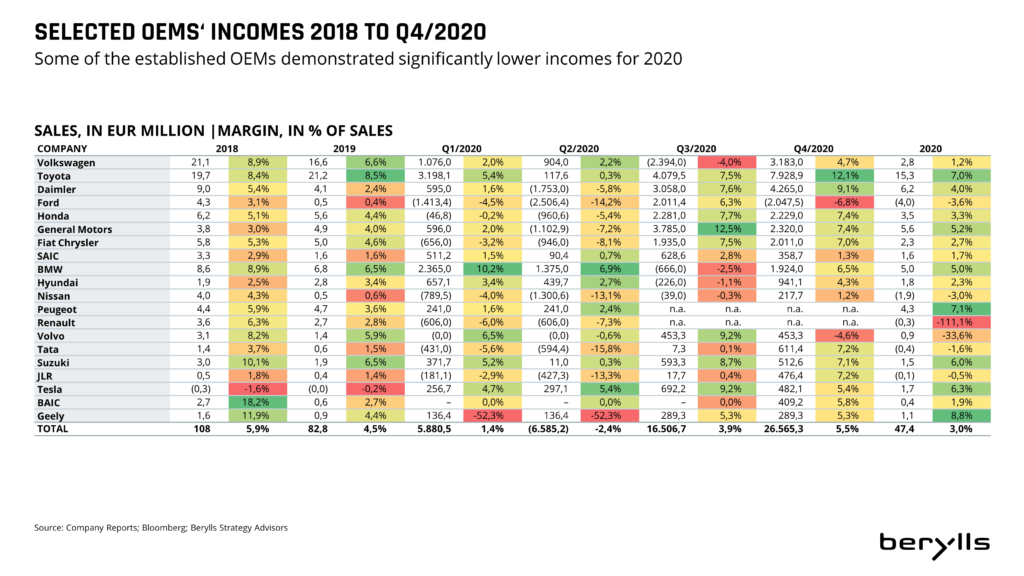

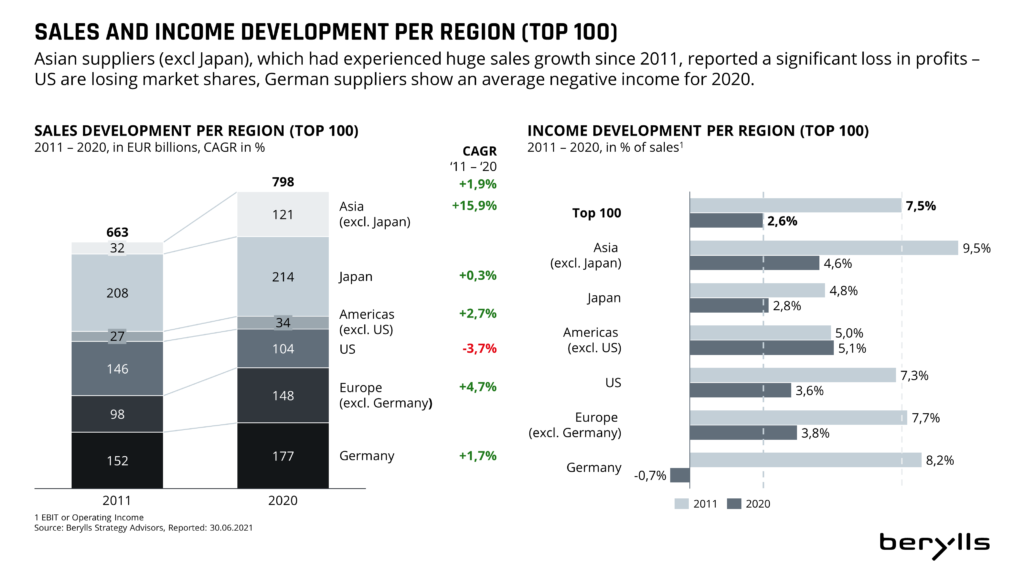

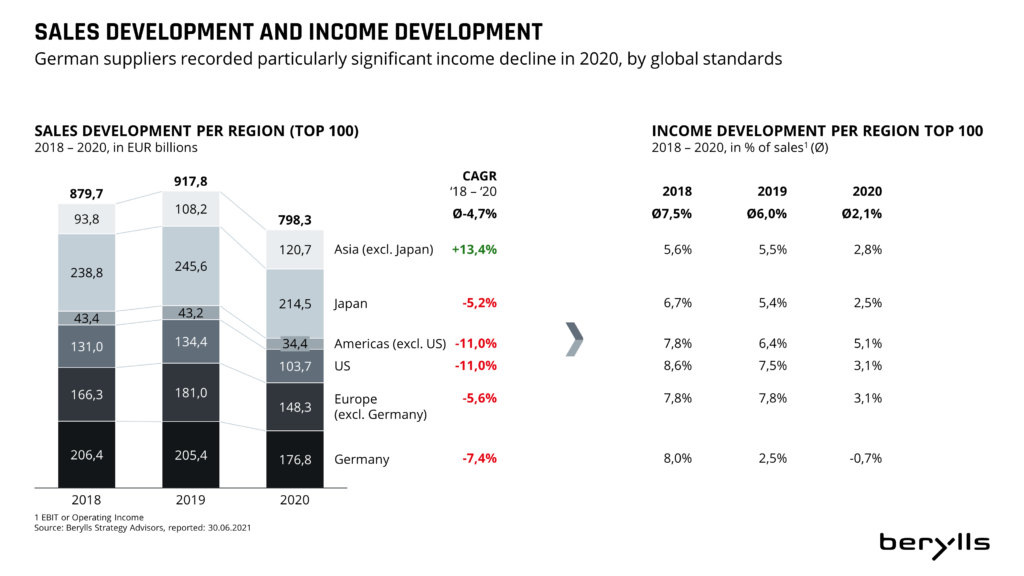

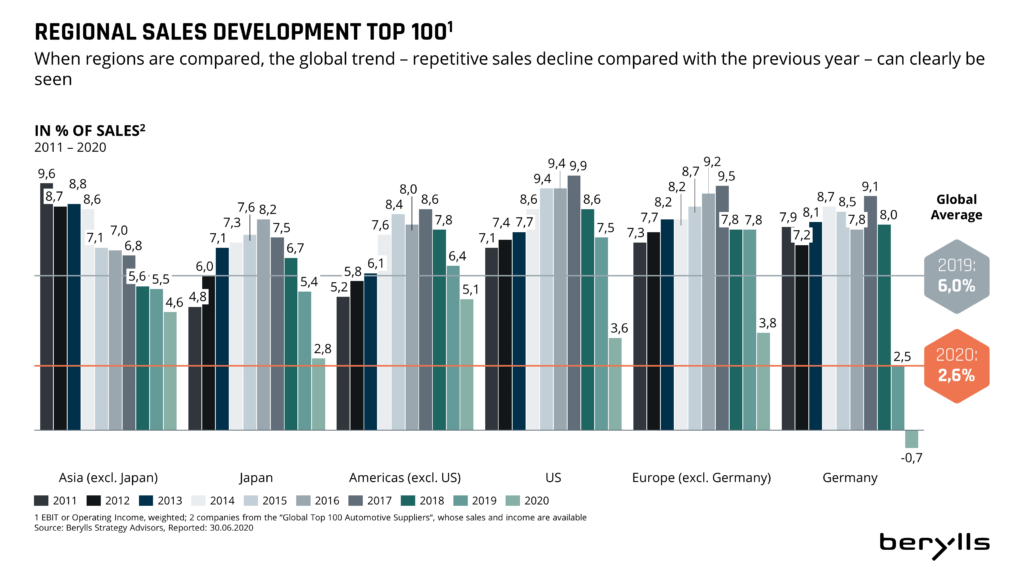

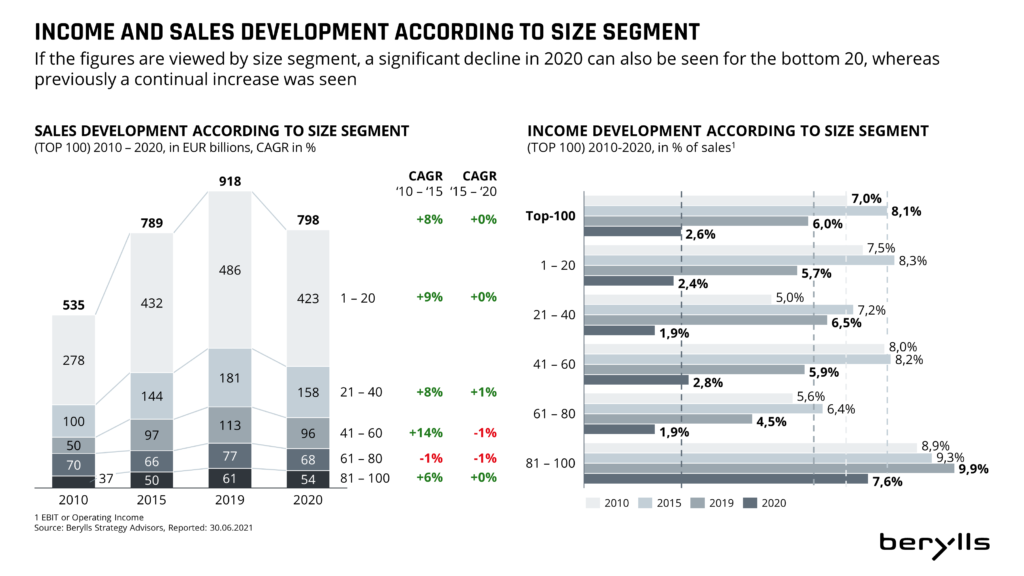

Looking in more detail at the numbers, turnover among the 100 largest automotive suppliers as identified by Berylls Strategy Advisors was 12.7 per cent down compared with 2019, when turnover increased by 4.3 per cent. Profitability among the top 100 declined by 58.1 per cent in 2020 in comparison with the previous year, and the average margin of the companies surveyed stood at 2.6 per cent less in 2020 – less than a half of the 6 per cent achieved in 2019.

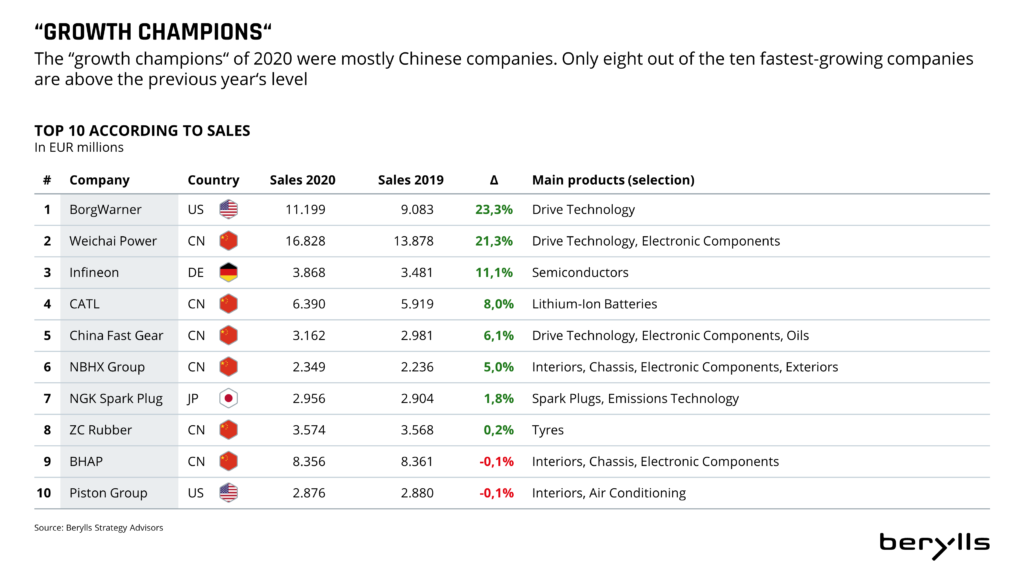

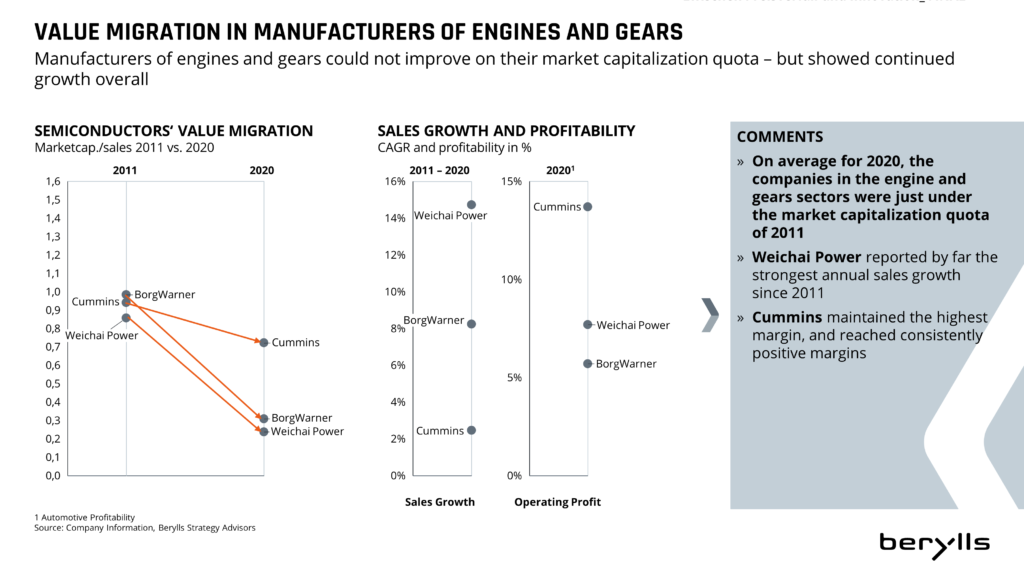

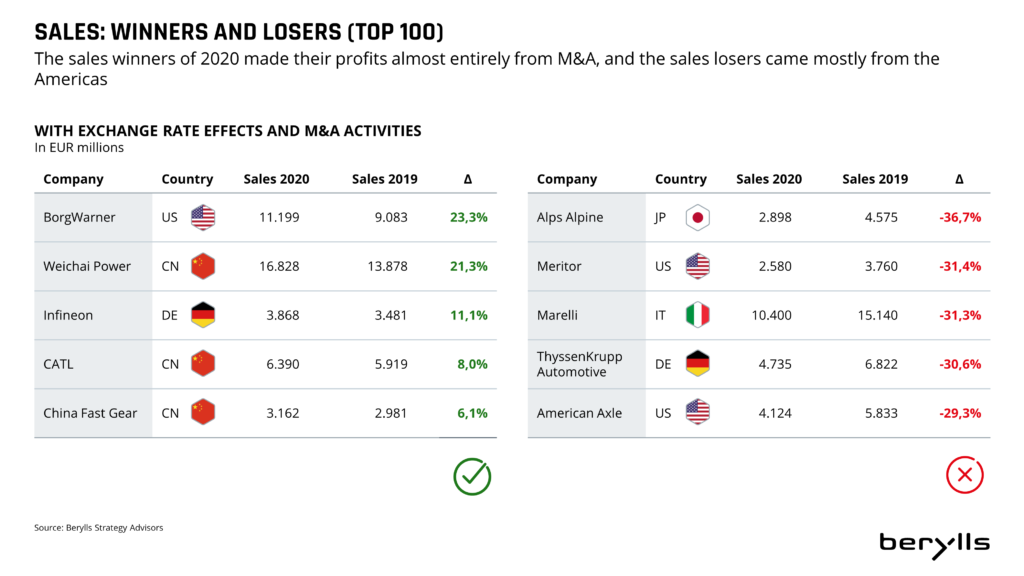

After a stormy year, for which the omens were already clear in 2019, the analysis by Berylls shows that whereas normally ten companies with the strongest growth in turnover could be selected, this time there were only eight. That was the number achieving a greater turnover than in the previous year. The 9th and 10th places in 2020 went to the two suppliers showing the least reduction in turnover in the Top 100. The main reasons for this are the effects of the Coronavirus pandemic. In the course of the past year both OEMs and suppliers had production stoppages. These stoppages along with reduced demand were the cause of significant loss of sales for the companies. It was mainly through acquisitions that companies such as BorgWarner (Delphi Technologies), Weichai Power (Aradex, VDS) or Infineon (Cypress) succeeded in increasing sales into a respectable double figure range.

There were mergers throughout the year. For example, Hitachi Automotive Systems, Keihin Corporation, Showa Corporation and Nissin Kogyo merged with the Japanese “Top 20” supplier (planned turnover for 2021 of 13 billion euros) Hitachi Astemo.

It was mainly the Coronavirus pandemic and the resulting production stoppages which caused sales drops for the automotive suppliers industry in the past year. Every second German supplier is currently planning additional job reductions because of the effects of the crisis. To add to this, sales fell considerably and costs did not fall to the same extent. One prominent example for the problems caused by the pandemic is the German cable and wiring specialist Leoni, which had already got into difficulties beforehand and is included in the 2020 Top 100 companies even with a negative margin. 80 factories belonging to this supplier all over the world were closed at various times, and the majority of its 4,800 staff in Germany were on short-time work. Rescue came in the form of a guarantee issued by Bavaria, Niedersachsen and Nordrhein-Westfalen for an operating loan. This prevented the company from going bankrupt, and it promises improvements in sales and results for the current year. Some smaller German suppliers which are not included in the Top 100 had to tread the path to insolvency in 2020, such as rim manufacturer BBS, the battery factory Moll, the aluminium casting experts Finoba, the plastic components manufacturer Weberit Dräbing, and the die-cast components manufacturer Minda KTSN. Some have already been taken over by investors or at least have the prospect of a restructuring. So the wave of bankruptcies announced in the previous year’s report has well and truly arrived. However, unlike the finance crisis of 2009 it has turned out to be a lot milder and mostly affects medium-sized companies in the supplier industry.

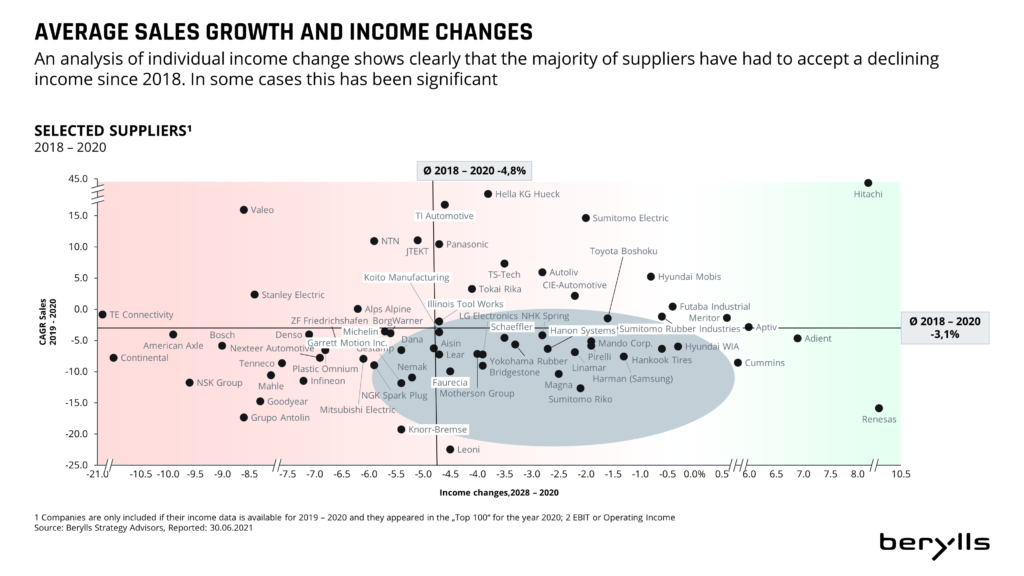

Five German and five Japanese Top 100 companies were making a loss in 2020 and account for over a half of the 17 suppliers with a negative margin. However, taken as a whole these companies are more like exceptions for Germany and Japan, as a total of 17 German and 27 Japanese automotive suppliers are represented in the Top 100. Germany’s loss-making companies are ZF Friedrichshafen, Continental, Bosch, Mahle and Leoni. The US loss-making companies range from American Axle which leads the loss-making companies with a -8.4 per cent operating income margin, to Goodyear which has a -0.1 per cent operating income margin and is the last on the negative list. Three Japanese companies are nudging zero growth: NTN (-1.1 percent OI), JTEKT (-0.7 per cent OI) and Denso (-0.7 per cent OI). The loss side consists of manufacturers from various fields, from mechanics to electronics.

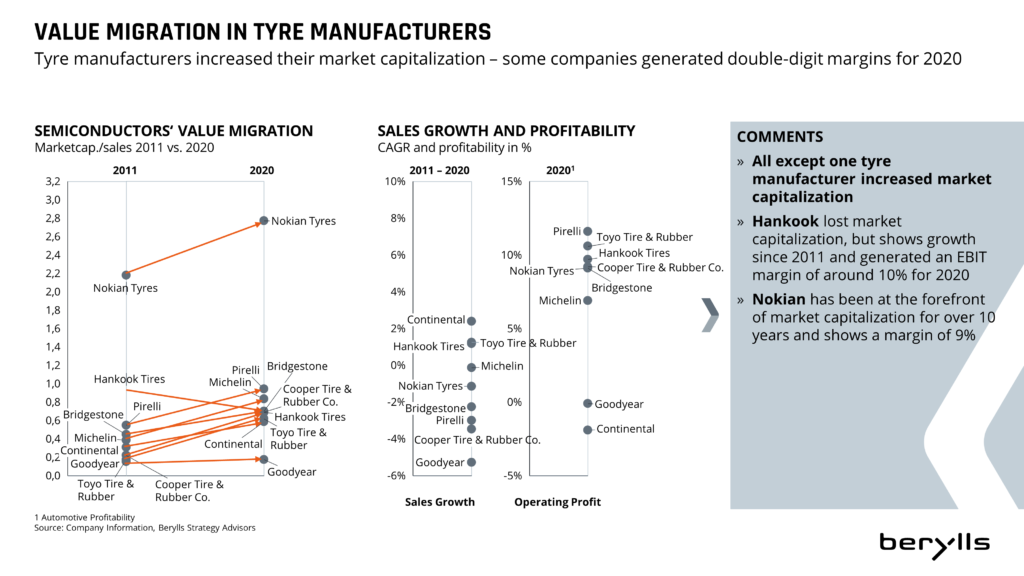

On the other side, this year’s “Profitability Champions“ are also from a very heterogeneous field. The most profitable companies occupying the top ten places are a varied mixture. The top performers come from six different countries and it is mostly telematic specialists and tyre manufacturers realizing positive margins. The top 3 most profitable companies in 2020 are Illinois Tool Works (USA, 17.8 per cent OI), Aptiv (Great Britain, 16.2 per cent OI), and Renesas (Japan, 14.2 per cent OI). The manufacturers with the highest margins were all tyre manufacturers: Pirelli (Italy, 11.6 per cent EBIT), Toyo Tire Corporation (Japan, 10.6 per cent OI), and Hankook Tires (Korea, 10.6 per cent OI). This is despite considerably lower demand in 2020 which had a negative effect on the margins of many other suppliers.

For the sixth year running Bosch is top of the list of the 100 largest automotive suppliers worldwide. The places immediately below Bosch, down to 9th place, go to the same companies as in the previous year. Weichai Power secures 10th place as the first Chinese company in the Top 10, dislodging Valeo (consistently at 10th or 11th place since 2017). This Chinese motor specialist is already well-known as one of the rare sales winners in 2020 and was only at 27th place when the Top 10 list was first published in 2011. Some companies did better than others in the crisis year, and this is largely dependent on geographical location. Suppliers based in Asia and/or with customers in Asia were able to profit from the ability of these countries to regain an attractive economy relatively early. Denso sends Continental down to third place and secures the 2020 silver medal. Magna slides from place four to place five, while ZF profits mainly from the acquisition of Wabco. Also, competitors Michelin and Bridgestone swop positions and now occupy places 8 and 9.

In the past year the effects of the Coronavirus pandemic converged with strong growth in the electromobility sector. Automotive suppliers had falls in sales and production stops to contend with and the majority could not avoid making job cuts. Battery and semiconductor manufacturers remain on a growth path, and so manufacturers such as CATL are increasingly looking for new staff. But European OEMs are dependent on Asian manufacturers such as CATL, Panasonic, BYD or LG Chem. In order to counteract this dependency, Germany will be developed into a European battery centre in the coming years. Various corporations are already working with battery specialists, both on the OEM side and on the supplier side, and throughout Europe Germany is scheduling by far the most projects in the battery manufacturing sector. By 2030 up to 100,000 new jobs will be created in Germany for this sector. German automotive suppliers such as Dräxlmaier, Webasto or Elring, which are already suppliers of battery technology, can also benefit from this.

Suppliers are increasingly adapting their strategies under the keywords electromobility and future technologies. LG is leaving the smartphone business and planning to concentrate on the growth area of components for electro vehicles, networked devices and artificial intelligence. BorgWarner would like to base their growth on acquisitions and at the same time develop more in the electro sector. Infineon’s strategy is to strengthen their core business with semiconductors and the exploitation of new growth markets, and this is what led to the above-mentioned acquisition of Cypress.

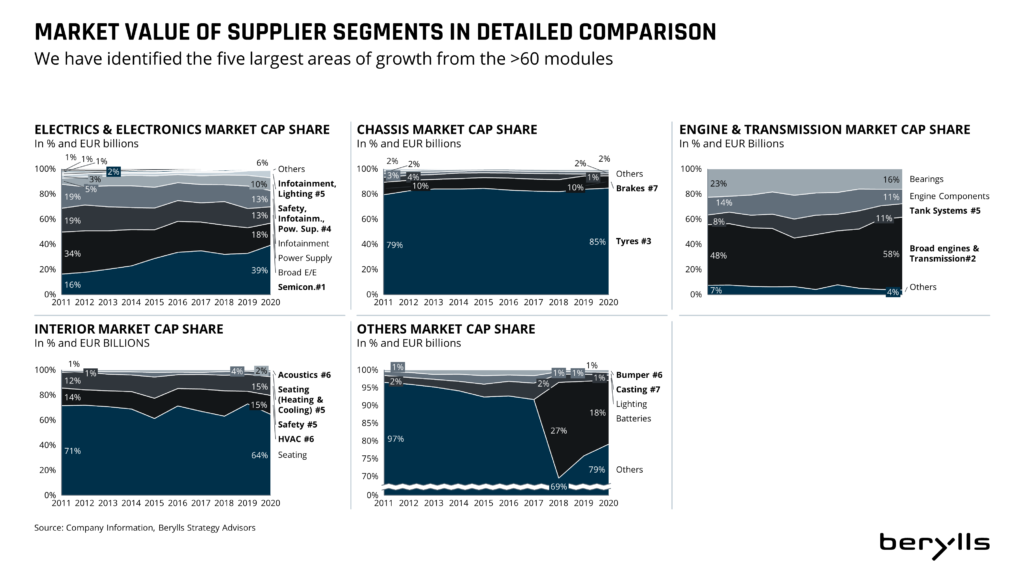

Berylls has been observing the Top 100 worldwide automotive suppliers for ten years. During this time there has been much movement and change both on the markets and on the shop floor. Back in 2011 the industry was on an upswing after the global financial crisis. After that, sales rose year on year, from 2011 onwards (663 billion euros) until 2019 (914 billion euros), by 38 per cent altogether which is a yearly average of 4.1 per cent. And the profitability of the 100 largest suppliers improved every year until 2017, standing at consistently over 7 per cent from 2012 until 2018. In 2020 the total sales of the Top 100 stood at around 800 billion euros – about 20 per cent above the level ten years ago. Profitability, on the other hand, stands at an all-time low of only around 3 per cent – although in 2020 this was largely determined by the pandemic. In 2019, the year before the pandemic, the margin still stood at 6 per cent, a comparable level to 2011 (6.7 per cent). So what has been going on these past ten years?

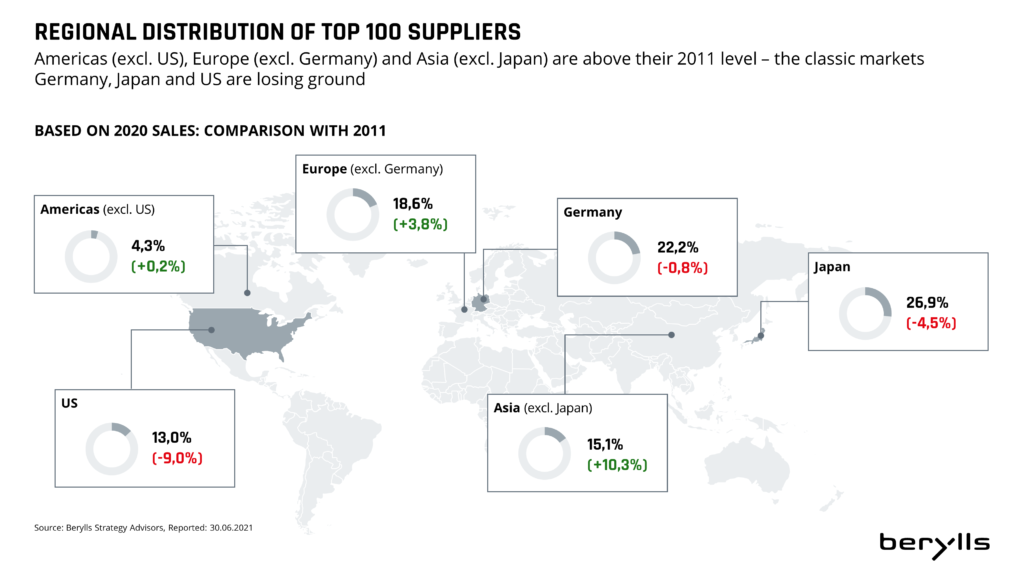

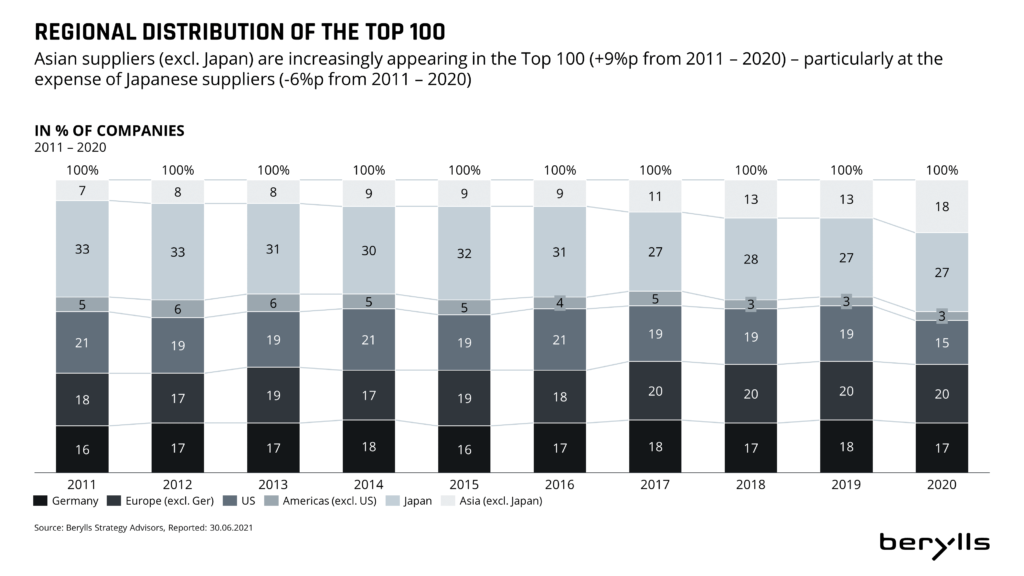

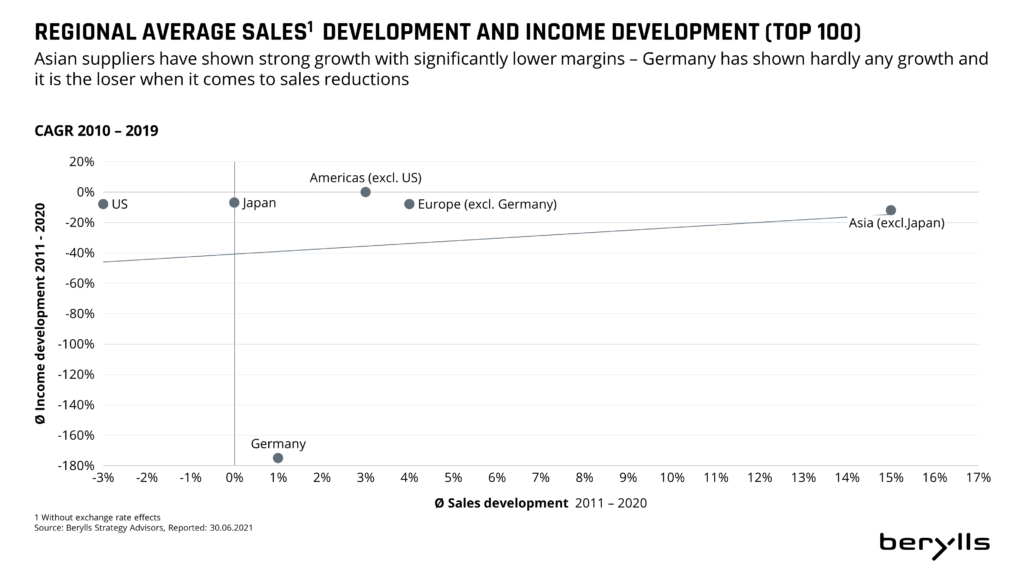

The geographic distribution of the large suppliers changed in the course of time. There were marked relocations of suppliers from Germany, Japan and the US to Asia. Asian suppliers (apart from Japan) have been forfeiting profitability since 2011 due to their huge sales growth, but have increasingly appeared in the Top 100.

Nine times as many Chinese suppliers made it into the Top 100 in 2020 as in 2011. At that time only Weichai Power was on the list, at 25th place; for 2020 they are ranked 10th, and they now have eight other Chinese companies spread out over the whole of the Top 100 behind them.

The biggest sales winners since 2011 are ZF Friedrichshafen and Tenneco. Bosch took over the top position from Continental in 2015 and has successfully defended this position every year since then. Continental held the top position from 2011 until 2014, slightly ahead of Bosch every year. The Top 100 companies recorded four completely loss-free years between 2013 and 2016.

The best progress within the Top 100 was made by Dräxlmaier (+ 31 places), Grupo Antolin (+ 25 places), and NGK Spark Plug (+ 21 places). The companies who lost the most places were TS Tech (- 41 places), Pirelli (- 31 places) and Meritor (-28 places, after splitting up).

Some companies were seen to come and go during the last decade. Concerns such as Johnson Controls and Honeywell split off their automotive sectors. The suppliers TRW, Delphi Technologies, Calsonic, Behr and Wabco were taken over. Yet more were not able to keep up with the continual sales increases exhibited by the other Top 100 participants and were removed because they were too small, for example IAC, Rheinmetall Automotive and Cooper Standard. The splitting off of parts of companies has also led to new additions over the years. So current occupants of the Top 100 such as Aptiv, Adient, Clarios or Garret Motion have been there for a few years now in the course of their independence. Some suppliers have made it onto the top performers‘ list under their own steam because of strong growth in sales, such as Flex-N-Gate, CATL, Piston Group an the German representatives Aunde, Freudenberg and Infineon.

The coming 10 years will see more marked upheaval. Suppliers with a high proportion of combustion engines like Mahle, BorgWarner, Tenneco or Eberspächer will be pushed to the bottom if they do not take countermeasures. Electric/electronic concerns with strong software skills, like Continental, Bosch or Hella, will grow disproportionately. The Asian concerns, especially the Chinese supplier companies such as the players from IT and entertainment electronics, Huawei, Samsung and LG, will continue to gain importance through acquisitions (also) from traditional companies. The emphasis will shift more strongly in the direction of Asia. However, German suppliers are well equipped to master the next phase of the transformation.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.

Featured Insights

eutschland war einmal Vorreiter bei der Brennstoffzelle. Doch neue Impulse, um die Technologie in der Breite zu etablieren, kommen aktuell überwiegend aus Asien.

Während sich Deutschland darauf festlegt, die Brennstoffzelle vor allem im Fern- und Güterverkehr zu fördern, planen China, Japan und Korea massive Investitionen auch bei PKW.

Anders als in Deutschland hat man dort erkannt, dass der PKW zwar nicht die Anwendung der ersten Stunde, sehr wohl aber der zukünftige Volumenträger der Brennstoffzelltechnologie sein wird.

China leitet sogar den größten Teil der vorhandenen Mittel für sogenannte New Energy Vehicles (NEV) auf FCEVs um – die bessere Skalierbarkeit der Ladeinfrastruktur von Brennstoffzellen ist dabei in Chinas Megacitys der entscheidende Faktor.

Ein weltweiter Absatz von über einer Million FCEVs im Jahr 2030 ist absolut realistisch. China allein hat sich für das Jahr 2030 dieses Ziel gesetzt; Toyota und Hyundai planen bis dorthin ebenfalls jeweils 500.000 FCEVs zu produzieren.

Damit droht Deutschland ein weiteres Mal bei einer zu großen Teilen in Deutschland mitentwickelten Technologie den Anschluss zu verlieren.

Einst galt Deutschland als Vorreiter beim Thema Wasserstoff. Die Bundesregierung versucht – auch mit Mitteln des kürzlich verabschiedeten Konjunkturpakets zur Eindämmung der wirtschaftlichen Folgen der Corona-Pandemie – inzwischen verlorenes Territorium wiedergutzumachen. Sie verfolgt dabei die Strategie, die Brennstoffzelle vor allem im Fern- und Güterverkehr zu fördern, nicht jedoch bei PKW.

Mit Blick auf den Absatz von FCEVs (Fuel Cell Electric Vehicles) scheint die Bundesregierung mit dieser Strategie richtig zu liegen. Im Jahr 2019 waren lediglich drei Modelle verfügbar, von denen weltweit insgesamt nur knapp 7.000 FCEVs verkauft wurden. Mittelfristig werden kaum neue Modelle hinzukommen. Die meisten deutschen OEMs haben FCEVs entweder ganz aufgegeben oder planen höchstens ein Derivat in Kleinserie einzuführen. Aus Hersteller-Sicht konkurrieren FCEVs nämlich nicht nur mit BEVs, sondern auch mit Plug-in-Hybriden und sogar 48V-Systemen um immer knapper werdende Entwicklungsbudgets. Die Herausforderung, die ohnehin schon schwierige Symbiose von konventionellen und alternativen Antriebssträngen zusätzlich um FCEVs zu ergänzen, ist den meisten OEMs schlicht zu teuer. Zuletzt verkündete daher auch Mercedes, dass der erst 2019 eingeführte GLC F-Cell wohl ohne Nachfolger bleiben wird.

Neue Impulse, die Brennstoffzelle in der Breite zu etablieren, kommen vor allem aus Asien. So planen Toyota und Hyundai bis 2030 jährlich 500.000 FCEVs allein für den Einsatz in PKW zu produzieren. Erst kürzlich meldete Toyota zudem die Gründung eines Joint-Ventures mit vier in China lokal ansässigen OEMs zur Herstellung von Brennstoffzellen für Nutzfahrzeuge.

Die Brennstoffzelltechnologie ist vielfach erprobt und insbesondere im Nutzfahrzeugbereich schon gut etabliert. Nach Angaben des US-Energieministeriums sind allein in den USA etwa 20.000 wasserstoffbetriebene Gabelstapler im Einsatz. Der zum US-Konzern PACCAR gehörende Nutzfahrzeughersteller Kenworth nutzt in wechselnder Kooperation mit dem kanadischen Brennstoffzellenhersteller Ballard und Toyota bereits Testflotten kommerziell. In der Schweiz plant die private Initiative H2 Mobilität bis zum Jahr 2025 rund 1.600 mit Brennstoffzellen ausgerüstete LKW in Betrieb zu nehmen. Und das mit über US $ 700 Millionen finanzierte US-Amerikanische Startup Nikola sieht für das Jahr 2021 die Markteinführungen von Brennstoffzellen betriebenen LKW für den Fernverkehr vor.

Der Schweizer Initiative H2 Mobilität gehören neben dem Einzelhändler Coop auch Tankstellenbetreiber und Logistikunternehmen an. Das Konsortium bündelt somit alle nötigen Kompetenzen von der Erzeugung und Betankung bis zum Betreiben der LKW. In Los Angeles liefert Toyota neben den Brennstoffzellen für den Antrieb zudem stationäre Systeme. Diese Bündelung erlaubt eine gesamtwirtschaftliche positive Bilanz, in der sich der Anwendungsfall als Ganzes mittelfristig ohne Subventionen trägt. Ein solcher Ansatz ist überall da übertragbar, wo sich Regelverkehre ergeben. Aber selbst im logistischen Fernverkehr fahren inzwischen viele LKWs entlang fixer Routen – z.B. auch die sogenannten Milkruns, welche die Teileversorgung der OEMs sicherstellen. Vor kurzem haben Hyundai und der amerikanische LKW-Motorenhersteller Cummins ein Abkommen geschlossen, um gemeinsam Brennstoffzellantriebe zu entwickeln. Hyundai will dabei sein Wissen um die Brennstoffzellen einbringen, Cummins das Know-how rund um den Antriebsstrang. Zunächst wird der Fokus auf den nordamerikanischen Automarkt gelegt und beide Partner werden die Brennstoffzellen nicht nur für den Einsatz in Autos entwickeln, sondern auch für stationäre Systeme, etwa für Notstromversorgungen.

Voraussichtlich werden nur wenige OEMs in eine eigene FCEV-Technologie investieren. Der Großteil der Antriebseinheiten wird von spezialisierten Herstellern ganzer Brennstoffzellensysteme kommen. Im LKW-Bereich ist es heute schon üblich, dass OEMs auf eine Mischung aus Eigenentwicklungen und zugekauften Antriebssystemen setzen. Dies ermöglicht eine Volumenbündelung auf nur wenige Systeme bei entsprechend geringeren Entwicklungskosten für den einzelnen Abnehmer. Hersteller wie Ballard, SHPT, Doosan oder Bosch schaffen auf diese Weise branchenübergreifende Skalen und kombinieren Kompetenzen und Technologien über ein breites Spektrum von Anwendungen. Selbst Toyota und Hyundai legen ihre Systeme so aus, dass sie in PKW und LKW gleichermaßen zum Einsatz kommen können.

Auch das von Kenworth verwendete System besteht aus zwei Einheiten des Mirai-Systems. Und das nicht ohne Grund, denn China, Korea und Japan streben langfristig klar den Einsatz von Brennstoffzellen im PKW an.

Derzeit gibt es global nicht mehr als 400 Wasserstoff-Tankstellen. Japan verfügt mit 100 Stationen über das weltweit größte Netzwerk an H2-Zapfsäulen. Es folgen Deutschland mit 90 und der US-amerikanische Bundesstaat Kalifornien mit etwa 50 Stationen; in Korea und China sind es derzeit nur ca. 20 an der Zahl. Korea, Japan und China planen bis zum Jahr 2030 jeweils rund 1.000 H2-Tankstellen in Betrieb zu nehmen. China will dafür sogar den größten Teil der vorhandenen Mittel für sogenannte New Energy Vehicles (NEV) auf FCEVs umleiten und so bis zum Jahr 2030 rund 1 Million FCEVs auf die Straße bringen. Ausschlaggebend für das Umdenken in China ist dabei die bessere Skalierbarkeit der H2-Ladeinfrastruktur.

China, Japan und Korea eint der Versuch, durch eine enge Verzahnung von Unternehmen und öffentlicher Hand, die Brennstoffzellentechnologie auf eine breite industrielle Basis zu stellen. Anders als in Deutschland liegt der Schwerpunkt in allen drei Ländern jedoch auf dem PKW als zukünftigem Volumenträger. Hier zeigt sich deren Erfahrung im Zuge der Entwicklung von Lithium-Ionen-Batterien: Um die Auslastung von zeitweise leer stehenden Zellfabriken zu erhöhen, wurde lange Zeit der Einsatz von Lithium-Ionen-Batterien in stationären Anwendungen forciert – der Durchbruch kam jedoch erst mit dem Großserieneinsatz im PKW.

Der von Deutschland eingeschlagene Weg, Brennstoffzellen in erster Linie für LKW, Schiff- und Luftfahrt zu nutzen, greift langfristig zu kurz. Länder wie China, Korea und Japan haben erkannt, dass der PKW zwar nicht die Anwendung der ersten Stunde, sehr wohl aber der zukünftige Volumenträger der Brennstoffzelltechnologie sein und ihr so zum Durchbruch verhelfen wird.

Ein Volumen von einer Million FCEVs im Jahr 2030 ist leicht möglich. Das entspräche einem weltweiten Marktanteil von nur einem Prozent – und genau dem Wert, den sich China als Ziel gesetzt hat. Toyota und Hyundai planen ebenfalls ihre Fertigungskapazitäten bis 2030 auf jeweils 500.000 Stück auszubauen. Zum Vergleich: Um eine ähnlich große Zahl an FCEVs in LKWs auf die Straße zu bringen, müssten fast ein Drittel aller weltweit verkauften LKW auf Brennstoffzellen umgerüstet werden.

Die von den deutschen OEMs und der Bundesregierung verfolgte Strategie birgt somit die Gefahr, dass Deutschland zwar viel in die weitere Industrialisierung der Brennstoffzelle investiert, aber am entstehenden Massenmarkt nur ungenügend partizipiert. Konsequent wäre das Vorgehen der Bundesregierung nur, wenn – anstatt auf FCEV zu setzen – neben den BEVs auch E-Fuels gefördert würden.

Die Strategie, abzuwarten, bis eine gestiegene (oder künstlich herbeigeführte) Nachfrage die Produktion von Brennstoffzellenfahrzeugen in Großserie zulässt, wird nicht aufgehen. Es muss vorher gehandelt werden.

Als Gewinner der Brennstoffzellen-Technologie werden solche OEMs hervorgehen, die es schaffen, ihre Technologie über eine Vielzahl verschiedener, auch nicht-automobiler Anwendungen zu skalieren.

Dazu werden diese sich selbst als Unternehmer und Partner in Kooperationen einbringen müssen. Denn als OEM sind sie nur dann interessant, wenn sie potenziellen Käufern ganzheitliche Lösungen anbieten können, die neben dem Fahrzeug auch das Betanken und sogar die Erzeugung von Wasserstoff beinhalten.

Zulieferer sollten nicht auf die OEMs warten, sondern direkte Kontakte zur neuen Riege von Systemherstellern knüpfen.

Da diese in der Mehrzahl in Asien sitzen, sollte auch die Brennstoffzellstrategie unmittelbar aus den Standorten vor Ort getrieben werden.

Gleichzeitig darf der Einsatz im PKW nicht aus dem Auge verloren werden. Das betrifft sowohl die technische Auslegung neuer Systeme als auch die genaue Beobachtung der Märkte – insbesondere in Asien.

Andreas Radics (1973) ist seit 2001 als Strategieberater in der Automobilindustrie tätig und blickt darüber hinaus auf mehr als vier Jahre Berufs- und Führungserfahrung in der Industrie zurück. Bevor er als Gründungspartner 2011 Berylls ins Leben rief und aufbaute, war er bei den international agierenden Strategieberatungen Gemini Consulting und Oliver Wyman tätig.

Er zählt zu den führenden Köpfen für Mergers & Acquisitions sowie für die Entwicklung und Umsetzung von Unternehmensstrategien in der Automobilindustrie, ist Experte für eMobility und ausgewiesener Kenner des US-Marktes.

Studium der Betriebswirtschaftslehre an der Katholischen Universität Eichstätt, Wirtschaftswissenschaftliche Fakultät Ingolstadt.

Featured Insights

Kicking up a lot of dust, COVID-19 has made the form and shape of the future of automobility even more opaque. The objective of this insight is to function as a compass for players in the US automobility industry for the near-term future by providing a different perspective on what has and has not changed amidst the pandemic. The insight is structured into three sections: (1) A critical reflection of what American customers want, (2) a discussion of the impact on the automobility value chain, and (3) a synthesis of the strategic implications for automobility players operating across this value chain.

(1) WHAT CUSTOMERS WANT

The private vehicle will remain the cash cow of the automobility industry over the near-term future. Within this dominant segment, customers are demanding an omnichannel blend of physical and digital (retail) offerings. While connected services are on customers’ radar, their full unfolding is yet to come. Depending on the development of macroeconomic stimuli, electric passenger vehicles will remain a niche phenomenon in North America over the near-term future, just as automated driving.

(2) HOW AUTOMOBILITY PLAYERS REACT

Automobility supply has been shaken by COVID-19 with vehicle production having been kept at a standstill from mid-March through early May. The market capitalization and stellar performance of Tesla amidst the pandemic showcases the importance of greater digitalization of the customer experience. Beyond the immediate Corona manifestations, changes in the automobility value chain will rewrite the rules of the game. While incumbents’ DIY approach to the future of automobility gave room to new kids on the block, the required core competencies to champion this future will be too complex for a single player to handle alone.

(3) WHAT NOW

Future competition in the automobility industry will be between networks, not individual players. OEMs are recommended to internalize their home-turf core competencies at the customer interface and regarding the provision of the vehicle framework. CASE technologies should only be internalized if players can realistically achieve a sustainable competitive advantage in them. The underlying legal, financial, and technological risks of all other fields are best hedged in a network of complementary downstream and upstream partners.

Coping with the digital ramifications of the pandemic is only the qualifier for the longer-term game. Future success will be determined by performance within networks, not individual greatness. Formulate a clear vision and enhance prioritized core competencies, which will form your network value proposition. Now.

Andreas Radics (1973) has been advising the automotive industry as a consultant since 2001. In addition, he can look back on over four years of professional and management experience in industry. Before co-founding and building up Berylls Strategy Advisors in 2011 as one of its Managing Partners, he worked at Gemini Consulting and Oliver Wyman, two international strategy consulting firms.

Besides being one of the leading subject-matter experts in Mergers & Acquisitions as well as in the development and implementation of corporate strategies in the automotive industry, he is an expert in e-mobility and a proven expert on the US market.

Business administration degree at Catholic University of Eichstätt-Ingolstadt, Business Administration Faculty, Ingolstadt, Germany.

Martin French has over 25 years of experience in automotive OEM, Tier 1 suppliers & mobility startups with various high-profile international leadership, product development, operational, program management, strategic & business development roles. In 2012, after holding various senior management positions, he was appointed Global Vice President Customer Group at Webasto where he led the global business transformation for their US based customers with over $1bn in revenue.

Martin joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) as Managing Director in 2019 and leads the Berylls office in Metro Detroit, USA. His consulting focus is Automotive Suppliers & OEMs, Corporate Strategy & Business models, M&A, Restructuring & New Business Development & Go to Market.

Martin studied Production & Mechanical Engineering at Oxford Brookes University. He has lived in Michigan, USA, since 2012.

Henning joined Berylls in 2018, is an Associate Partner at the Berylls Group and is currently completing a regional assignment in Detroit to further expand our local footprint. Henning particularly focuses on topics at the interface of new business development, go-to-market strategies, sales as well as organizational transformation. He has advised automotive manufacturers, suppliers and investors on a global scale.

As an MSc. Management graduate, Henning has completed his education at WHU – Otto Beisheim School of Management (Germany), Kellogg School of Management, Northwestern University (United States) and Warwick Business School (United Kingdom).

Featured Insights

ith the xEV cockpit, Berylls once again analyses the lead markets of e-mobility. A look at the previous year shows that e-mobility has hardly gained any ground worldwide. In 2019, only 2.3 million BEVs and PHEVs were registered globally.

Andreas Radics (1973) has been advising the automotive industry as a consultant since 2001. In addition, he can look back on over four years of professional and management experience in industry. Before co-founding and building up Berylls Strategy Advisors in 2011 as one of its Managing Partners, he worked at Gemini Consulting and Oliver Wyman, two international strategy consulting firms.

Besides being one of the leading subject-matter experts in Mergers & Acquisitions as well as in the development and implementation of corporate strategies in the automotive industry, he is an expert in e-mobility and a proven expert on the US market.

Business administration degree at Catholic University of Eichstätt-Ingolstadt, Business Administration Faculty, Ingolstadt, Germany.

igns of a storm brewing - As it was, at the end of 2020, the year 2021 was not looking very promising. Despite a fundamentally positive outlook for the motoring industry, the uncertainties of 2018 and 2019 looked set to continue. Structural change, as well as consumer reticence and vehicle sales stagnation were harbingers of the end of a decade of strong growth.

The year 2019 also showed us that structural change would not proceed quickly – more likely step by step. The merger of Magneti Marelli and Calsonic; Continental’s founding of the company spin-off Vitesco; Tenneco’s takeover of Federal Mogul – all were signs of persistent, continual change for the car industry and its suppliers.

The German M&A market had hardly cooled off at all in 2019, with 293 transactions compared to 295 the previous year. But banks were already viewing credit payments to the car industry with concern, because of the difficult market setting. Despite cheap money and zero-interest policies, an icy wind was blowing around the financing of classical car manufacturers.

New technologies remained risky because of the uncertain market and legal position, as well as the halting monetization and sustainability of business models being trialed. At the same time, the traditional car business seemed to have an ever-closer expiry date. After a long period of growth, pressure for change grew strongly, and there was a push for appropriate investments and strategy changes in the supplier industry.

It took a little while for OEMs and suppliers to accept that they could only reach their targets in CASE technologies through collaboration, because the investments were too enormous for them to be able to manage on their own. But at the same time, political and social problems were destabilizing the market, and rapid change and monetization of new technologies – for example, connectivity services and cybersecurity – failed to emerge.

If we look at profit development in the last few years (-1.5 percent in 2019 compared to 2018, for the biggest 100 suppliers), we can see that there were numerous companies in the lower third of the supply industry which had slipped into the loss zone even before the Covid-19 crisis began in 2020. This alone would be manageable in the short term, but with structural change, the question arises as to whether or not many business models will be sustainable in the future. If old business is wobbling and new business is not yet firmly established, tensions arise and all participants need great skill and dexterity to adopt a clear plan out of the crisis and avoid insolvency.

If we look at the history of how insolvencies develop in the car industry in German-speaking countries, the number since 2010 has involved around 20 (±10) companies a year. However, the global financial crisis of 2008/09 demonstrates that this number can rise sharply in an economic crisis: there were over 80 insolvencies in 2009. Every percentage point of negative development in gross domestic product (GDP) leads to a proliferation in the number of insolvencies. In 2009, the GDPs of major automobile markets fell by between 2 percent and 6 percent (for example, in Germany, Japan, Great Britain and the US), whereas China showed strong growth of around 9 percent.

When it came to vehicle sales in 2009, Great Britain were particularly badly affected, with declines of between 10 percent and 20 percent. Thanks to an environmental bonus, Germany was able to generate a sales surplus of around 20 percent in 2009 compared with 2008, and in this way fended off a deep crisis. However, sales volumes decreased significantly in 2010, to significantly below the pre-crisis level (down 6 percent compared with 2008) and it was not until 2011 that they reached comparable levels again. All these figures are intended to give an idea of the future direction of sales after the Covid-19 economic crisis.

The current situation shows a similar picture for GDP forecasts as for sales. In April the IMF forecast declines of 6 percent for the US, 7 percent for Germany, Great Britain and France, 5 percent for Japan and a rise of 1.2 percent for China. If we line up the numerous crystal balls showing sales forecasts for 2020 and hazard a glimpse into an uncertain future, we will see a corridor reaching from declines of 20 percent to 25 percent for the global car market. There are pessimistic scenarios which paint an even more dismal picture.

Despite support measures for the DACH region – D (Germany), A (Austria) and CH (Switzerland) – Berylls is forecasting a sixfold increase in average insolvency figures for the period March 2020 to mid-2021. Altogether this will probably result in around 120 automobile companies sliding into insolvency. According to Berylls’ forecasts, up to 100,000 jobs will be affected.

Given that the automobile world was a very different one in 2009, after 2020 it will be more difficult to realize a similar story of successful recovery. On the contrary, Covid-19 could accelerate structural change in the German-speaking/European supply industry and even drive insolvencies above 120. The structural damage caused by this insolvency tsunami would be more significant, and the development of new structures would take considerably longer, prolonging the recovery phase. It is also unclear to what extent the banks are prepared to pay out money for the development of new motoring areas after the painful reduction of credit to car suppliers.

The same applies when we look at private equity companies, which can currently find better opportunities for ambitious returns in other industries. Rescue by investors and M&A activities looks difficult; on the one hand, sales prices have risen too high in the last few years while on the other, many financial investors are anxious either not to advance into sectors which they will not be able to sell later, or be unable to handle high expectations of returns. Strategists will proceed very carefully, for the moment preferring to keep hold of their money and wait for better times to make strategic acquisitions.

For takeovers out of insolvency there will be strategists who will have had wish lists for a potential expansion of their own portfolio for quite some time. So the following years could bring further insolvencies, perhaps above the 20 per year mark, and accelerate consolidation. In terms of sales, currently around €12 billion are in play, which come from suppliers who have got into difficulties this year and become insolvent. Reliable forecasts for the actual extent of this will not be calculated until the third and fourth quarter, by which time the number of notable insolvencies can be better quantified and described. We already have some notable examples: Veritas, DGH Druckguss Heidenau and Finoba.

One of the lessons from 2009 should be to avoid a downward spiral of continual pessimistic forecasts. It was such a spiral that tore through the car industry and led to the situation in 2009 in which significantly fewer vehicles were being produced globally than were required on the market. Whereas global demand only reduced by almost three million vehicles, almost nine million fewer were produced than in the previous year. A lack of communication and transparency over highly complicated supply chains made planning more difficult for all concerned, and it was existing vehicles which finally had to fill the trade gap.

If the industry does not manage to make a better job of orchestrating the ramp-up this time, and if participants do not read market opportunities properly, more damage could be done than in 2009. We must avoid a situation where capital is gained from the financial stress suffered by normally solid companies. In the medium term this would be alleviated if transformation was actually abandoned altogether. This is the reason why people are increasingly calling for structures to be created in which companies in trouble can find a safe harbor (e.g. takeovers using a fund created by banks, investors or unions). However, OEMs have an interest in keeping their highly complex supply chains stable and carrying out the supplier transformation in coordinated channels. It is not known whether “problem companies” might also land in this safe harbor – companies which would have been better wound up – otherwise the pace of this wise change in the industry will be slowed down.

The market will be reassessed, and it must be steered with measured judgement and supported at the right point. Alongside investments for CASE, other investments are needed to rebuild the supply chain, ranked in a similar way. The top priority at the moment is to secure liquidity, especially as many car suppliers in the supply chain are system-relevant. This alone is a mammoth task for the industry, and it is not enough on its own. New ideas are needed, for example the transparency mentioned earlier, to steer the ramp-up on the basis of demand.

In addition to all this, a mixture of purchase incentives to support the industry, including sustainability and environmental demands, needs to be provided through hybrids, battery electric vehicles (BEVs) or fuel cell electric vehicles (FCEVs). However, structural problems should not be concealed, and short-term purchase incentives should not again lead to medium-term over-capacity and an incorrect vehicle portfolio that runs contrary to long-term climate goals.

When it comes to rescue funds for suppliers, we should proceed with clear criteria for system relevance, continuation of structural change and a clear central control body, compatible with the market reassessment of “zombie firms.”

The setting of these parameters will define whether or not we will see an even higher number of insolvencies. There should be opportunities for all participants (including suppliers, banks, private equity firms, OEMs and politicians) to continue the change which has been set in motion, to transform the car industry. Powerful waves seem unavoidable, but they must be prevented from getting bigger and forming a tsunami.

Dr. Jan Dannenberg (1962) has been a consultant for the automotive industry since 1990 and became a founding partner of Berylls Strategy Advisors in May 2011. Until spring 2011, he worked with Mercer Management Consulting and Oliver Wyman in Munich, Germany, on international projects – for five years as Associate Partner, and another three years as Partner. He is a recognized specialist in innovation and brand management in the automotive industry, and primarily advises suppliers and investors on strategy, M&A and performance improvement. In addition he is Managing Director at Berylls Equity Partners, an investment company that specializes on mobility enterprises.

Bachelor of Arts in economics at Stanford University, USA; business administration and doctorate degree at the University of Bamberg, Germany.