WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

Munich, December 2021

armakers are spending as much as 5% per vehicle sold on warranty costs – but using available data to fix quality issues faster could cut that dramatically.

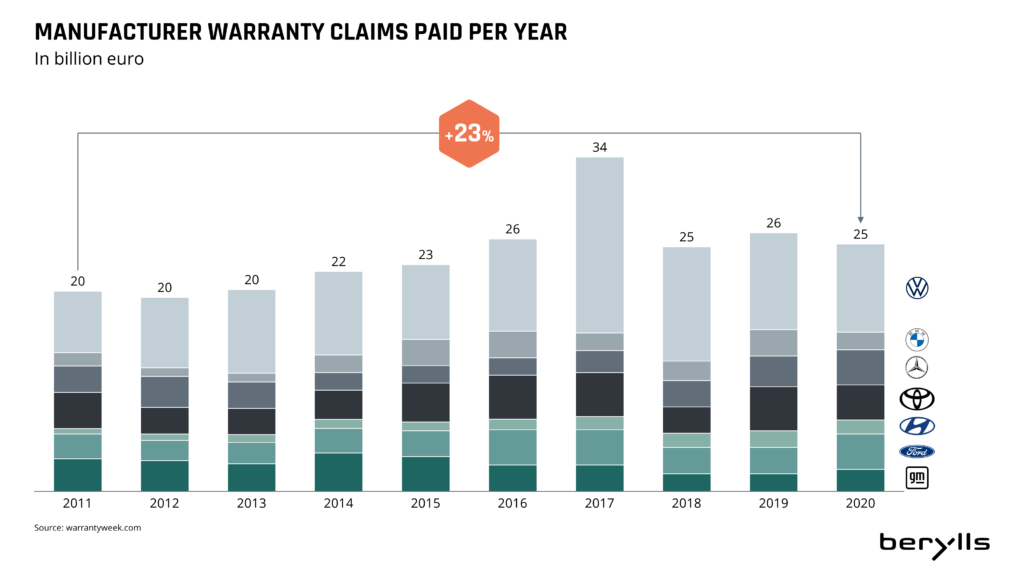

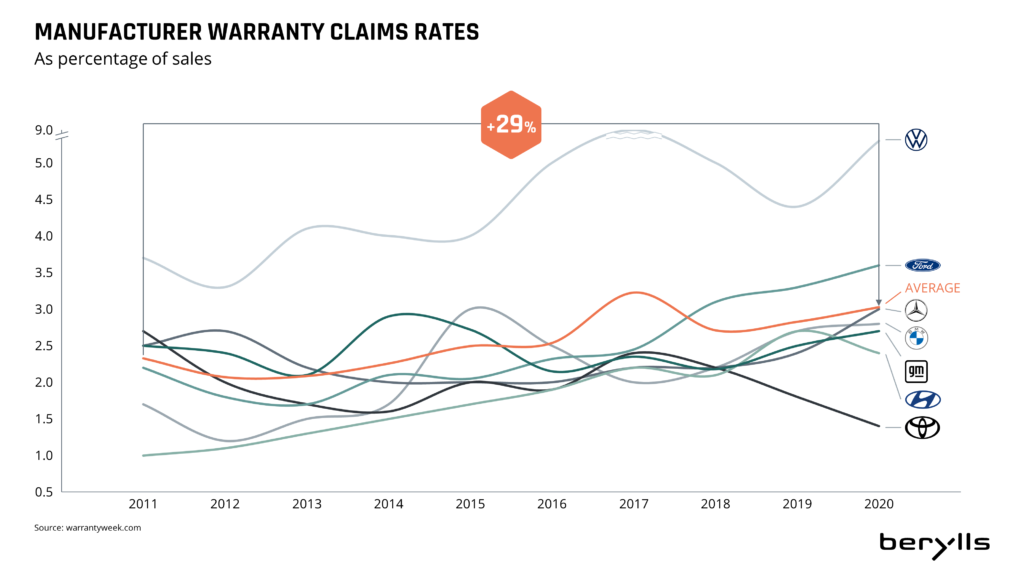

For carmakers, the cost of fixing faults on vehicles that are still under warranty is prohibitive. Taken together, seven of the largest OEMs are spending more than €25bn a year to address recalls, breakdowns, and quality issues (see chart 1.1). This is about 23% more than 10 years ago. Warranty claims now account for between 1% and 5% of sales at these OEMs (see chart 1.2).

Chart 1.1

Chart 1.2

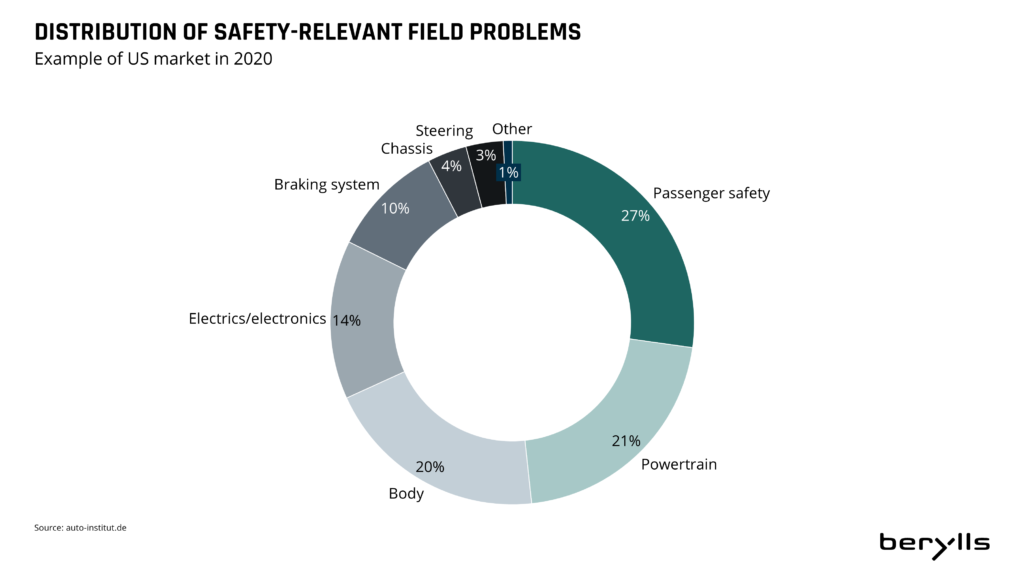

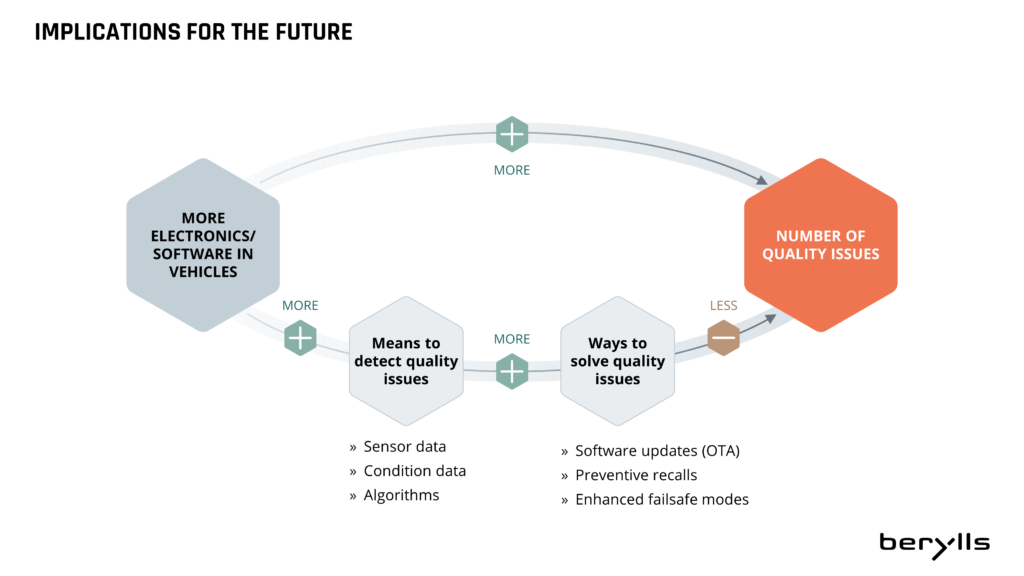

The most common problems leading to warranty claims are with safety features, followed by issues with the powertrain, the body, and increasingly, with the electronics (see chart 1.3). As cars become electric their systems become more complex and more dependent on software. As a result, the number of quality issues that need to be fixed is expected to increase substantially.

Chart 1.3

For OEMs, warranty costs mount up in several ways – from paying workshops to carry out the replacement work, and the cost of parts, to offering replacement vehicles and organizing recalls of a potentially large number of vehicles. Reducing the billions being spent now has massive potential to improve OEMs’ bottom line, and that will offer a much-needed boost at a time when they are investing heavily in new electric powertrain technology and production automation. Among European OEMs, for example, BMW spent around €1.8bn on warranty costs in 2020, while EBIT was €4.8bn, and Daimler spent €3.5bn, while EBIT was €6.6bn.

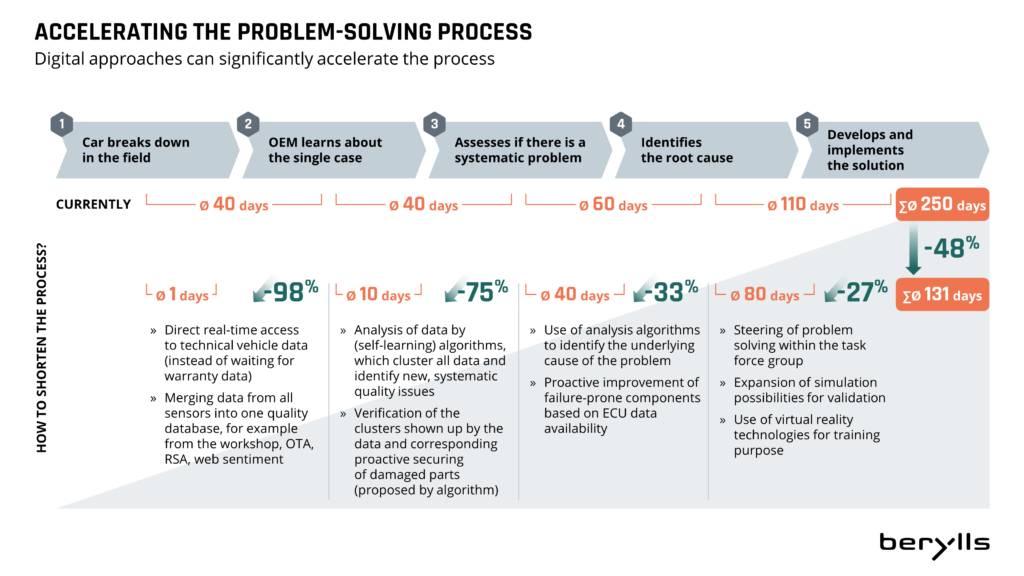

The current approaches to reducing warranty costs are somewhat incremental and have not stopped costs from building up. From our experience working with OEMs, the data already exists to enable far quicker resolution of quality issues and to do this in a more coordinated way. Doing so would significantly cut the time it takes from detection to solving a problem at its root, which – from our project experience – currently takes an average of 250 days. We believe that time could be cut by close to half.

In this paper, we will look at what a data-driven approach can achieve when it comes to saving time and money.

Field problems can occur because of issues with the specification or design of the part, faults on the manufacturing side – or because customers use the vehicle in a way it was not designed for.

OEMs need to understand whether the quality issue was a one-off unfortunate occurrence, or a systematic problem in production or design. In the latter case, the same fault is replicated and built into thousands more vehicles day by day, causing warranty costs to mount up. Every additional day it takes to identify the root problem and solve it costs the OEM money.

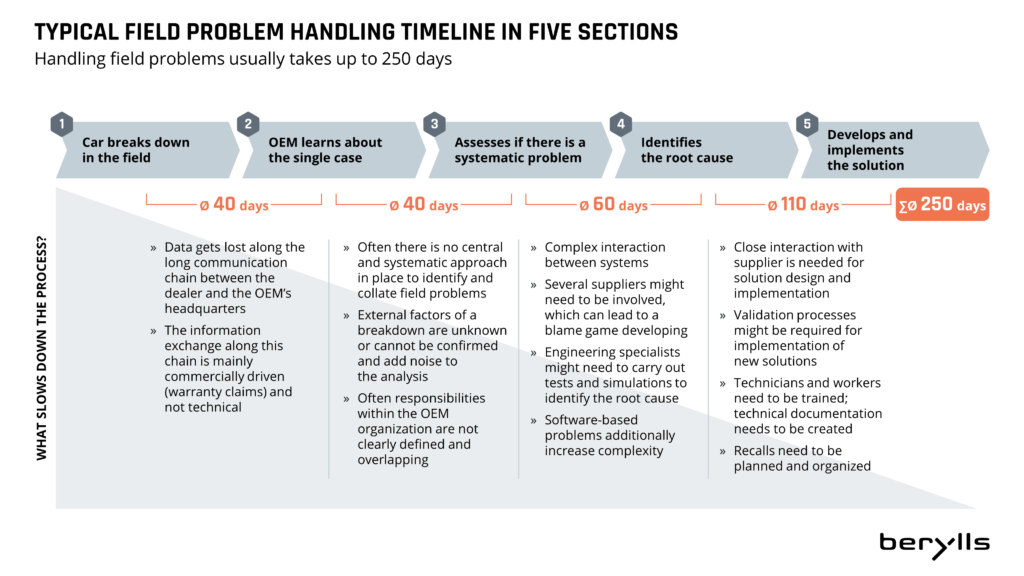

However, the way carmakers deal with quality issues has not significantly improved for a number of years. The process typically has five milestones: the incident happens, information about it reaches the OEM, the fault is assessed to find out whether there is a systematic problem, the root cause of the problem is identified, and finally, a solution is developed and implemented (see chart 2.1).

Chart 2.1

Reporting a quality issue alone requires several separate lines of communication with different organizations: dealerships usually operate independently of the OEM, and OEMs mainly only find out about the fault that was fixed much later, when they receive a warranty claim. That is a financial document rather than a detailed description of the fault, and the OEM misses the opportunity to gather more details and compare the fault with other recent problems that may have been reported from elsewhere. By the time the OEM realizes that a single case is worth further investigation, that car has been back on the road for a while. Therefore, one of the most important challenges is for OEMs to find ways to identify potentially systematic problems much faster.

When it comes to identifying the root cause, the problem is that cars today do not always provide the data required for analysis, nor is it available in a standardized format. The first step is an analysis of the failure codes, however there may not be a code for the exact problem, and what caused it in the first place is not transparent because underlying measurement data is not available.

Another obstacle to overcome is the masking effect of environmental data. Does the problem only occur when it is hot outside? After the car was idling for a long time? When the fuel quality is low?

When the root cause is finally found, the most time-consuming phase begins: the development and implementation of a solution. Here, suppliers play an important part and need to be coordinated by the OEM. The solution then needs to be tested and validated, and mechanics trained to apply the solution in the field.

OEMs know there is an urgent need to tackle the overall inefficiency of this way of dealing with quality issues, particularly as their number is likely to go up.

Every phase of the fault identification and correction process described above can be drastically shortened with the use of data. Based on our experience with clients, we estimate the time for the entire process can be cut by close to half (see chart 3.1).

Chart 3.1

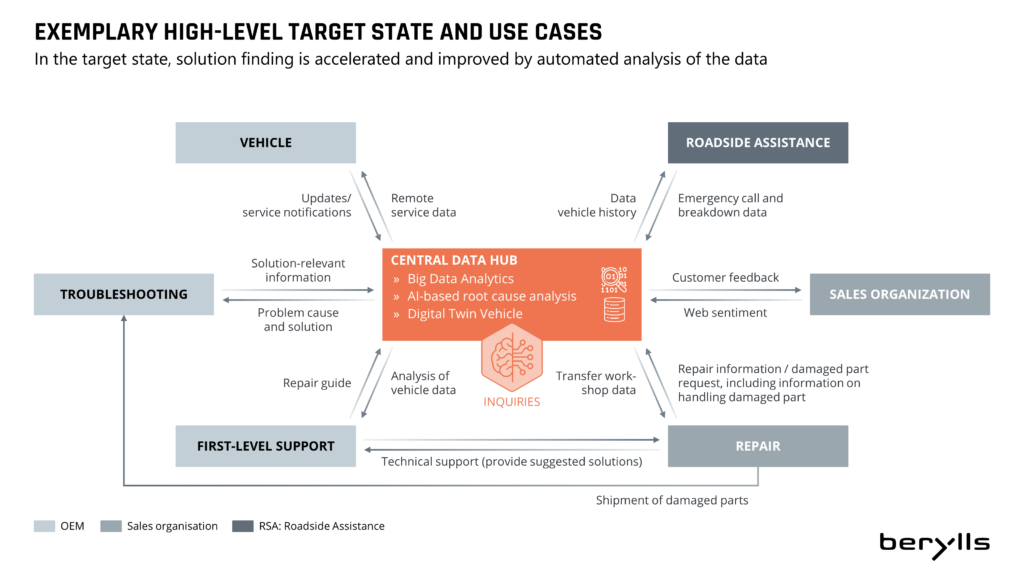

These significant projected improvements are based on data available today and do not require additional information. However, the prerequisite for embarking on the transformation is that OEMs must consistently collect available data from and about vehicles in the field in a central data hub. It can be transferred from the vehicle by a readout at the workshop or over the air as remote service data, from roadside assistance or from web sentiment (see chart 3.2).

At present, vast amounts of data are generated within vehicles but not transferred or used to the full extent. This will become easier in future, as more cars are built with the ability to transfer data over the air in near-real time and 5G networks grow. OEMs need to be prepared for this next step, and they already have the potential to start exploiting it today.

Chart 3.2

OEMs must then share the data collected across the organizational silos that currently exist: there are walls between dealers, OEMs and suppliers, and within the OEM, there are barriers between the sales organization, engineering teams and the quality control department. Carmakers need to act now to dismantle these walls so groups can pursue the same goals with the same systems, using the same data. Data privacy laws may create barriers, but it will pay off for OEMs and suppliers to work with data protection experts to find solutions.

Once OEMs have collected the data and made it accessible, they can apply analytics algorithms. As a first step, all instances of known and previously explored quality issues are identified automatically. If there is no need to further analyze these cases by, for example, doing tests on failed parts, the case is automatically sorted out by the algorithm without taking up time in an engineering department.

As a second step, the algorithms automatically cluster together the remaining instances of quality issues. By doing so, systematic quality issues are made transparent significantly faster than when screened by a human. This could potentially be done by a separate business within an OEM. After a few weeks of learning, algorithms are able to detect anomalies and flag them as potentially interesting cases for further analysis.

There is also further potential for digital processes during root cause analysis: OEMs should be using modern algorithms and simulation tools help to narrow down the underlying issue, and in the future, digital twins will help to make the process even quicker.

However, putting in place a holistic, data-driven approach to dealing with quality issues is about more than the data itself. We believe there are two non-digital actions required to make full use of vehicle data:

One example is to make it easy to request that a failed part which is potentially causing a quality issue is sent in for further inspection. This could be done via the display of the testing device when a mechanic receives the repair diagnosis, with the shipping label printed on the spot. Currently, OEM development engineers phone the dealers where a vehicle was repaired weeks later and, in many cases, find out the part has been scrapped.

We believe a human quality scout needs to play a central role in taking a final decision on whether a problem needs further investigation, and then coordinating the steps in the process.

One more important aspect which OEMs should not forget is ensuring the new process is beneficial for customers. A holistic and digital process for identifying and solving quality issues will also help to create a positive customer experience, even in the worst situations like a car breakdown. A tow truck driver who knows how many people are in the car and how long they have been waiting could, for example, deliver food and drinks in the right quantities to the driver and passengers.

Chart 4.1

In the future, a two-way flow of data between the car, OEM, and other relevant parties will be standard. Customers and OEMs will benefit from a connected ecosystem that links edge computing with cloud services and programming tools that enable fast, flexible analysis of vehicle data. Data analysis jobs will be platform- and manufacturer-independent and will be carried out by analytics service providers rather than by OEMs themselves.

Warranty claims now account for between 1 and 5% of sales at these OEMs Using vehicle data to understand faults has become simpler and easier than in the past, unlocking the possibility of cutting the time it takes by close to half, with a significant improvement to profitability. OEMs don’t need to wait: data-based solutions available now can significantly cut the time and cost of identifying the root cause of faults and developing and implementing solutions.

OEMs don’t need to wait: data-based solutions available now can significantly cut the time and cost of identifying the root cause of faults and developing and implementing solutions. This will bring down warranty costs substantially.

The critical change to make is to reduce the time taken at every stage of the process. Using vehicle data to understand faults has become simpler and easier than in the past, unlocking the possibility of cutting the time it takes by close to half, with a significant improvement to profitability.

It will also improve the customer experience of the fault-resolution process, increasing loyalty and retention. This means OEMs should involve their aftermarket organizations in the implementation of the five dimensions described above, to ensure they are built in a customer-centric way.

Success requires OEMs to take a cross-organizational approach, and to work more collaboratively within the company, bringing in customers, dealers, suppliers, and breakdown organizations, to create a holistic, truly data-driven solution.

Philipp M. Stuetz (1981) joined Berylls at the beginning of 2021. He has over fifteen years of experience in the automotive industry. Thereof he spent seven years at an international automotive supplier with assignments in Spain, the USA and Mexico and over eight years in consulting. His focus is in operations excellence, especially in large transformation programs, process optimizations and efficiency improvements in administrative functions and indirect operations areas. He counts suppliers and OEMs to his clients alike.

Philipp M. Stuetz graduated in business administration from the universities of Stuttgart and Strasbourg.